The post below is for my International Political Economy class (PS 404). The focus is on understanding the long-term causes behind the 2008 market meltdown.

______________________________________

There are many reasons that our market collapsed in 2008. If we understand these we're better equipped to understand why it's going to happen again (and it will). Below I draw from my book to present ten developments that helped create the conditions for the market collapse of 2008. What you'll see is that 2008 wasn't some kind of '

once in a century credit tsunami' that couldn't have been foreseen. It was the result of very deliberate steps that included putting market blinders on our politicians and society (which we seem to be doing once again).

You can quibble with one or two of the 10 points, and can definitely make a case for emphasizing one point over another, but the reasons for our 2008 market collapse - and the logic behind our next collapse - can be found below.

With that, our 2008 market collapse in ten easy steps ...

THE BEGINNING

1.

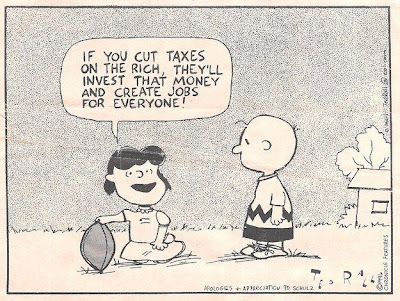

A Naive Belief in "Free Market" Ideology (blinds policymakers)

... U.S. leaders effectively

ignore the economic costs associated with (1) paying for the defense of the west, (2) America's failure to adapt to globalization and new competition (produced, in part, by the success of Bretton Woods), (3) the structural changes in the economy caused by the rise of financial services sector (i.e. the "symbolic" economy), (4) Nixon's price controls, and (4) the impact of OPEC's inflation inducing price hikes.

... Instead of confronting the costs associated with paying for the cold war, competition from abroad, the financialization of the economy, Nixon's price controls and OPEC price hikes, America's leadership blames the sluggish U.S. economy on "the state" (regulations, domestic programs, and taxes), while calling for "a good 'ol shot of capitalism" in 1980.

... Ronald Reagan enters the White House after Maggie Thatcher becomes Britain's Prime Minister.

Trickle Down Economics is born. Deregulation and tax cuts for the rich are embraced. Militarism, new global competition, financialization and OPEC price hikes are effectively ignored.

... The free market is embraced after Reagan leaves office in spite of the fact that Reagan dumped trillions in borrowed money into the economy, almost tripled the national debt, raised taxes on the middle class (FICA), and lifted the debt-limit ceiling 17 times. Reagan's accomplishments are attributed to him being a fiscal conservative and free marketeer.

BUILD UP: 1970s-1980s

2.

Deregulation / Financialization of Economy (regulators take a vacation)

... 1971 the dollar is de-linked from gold and becomes a commodity. A formal futures market develops for money, interest rates, and other novel investment tools of the financial community.

... OPEC price hikes wreak havoc on markets and prices. Pundits and foreign policy experts alike (see especially Henry Kissinger) are caught flat footed.

... new policies and

deregulation are pushed by financial services sector, which make the Savings & Loan and other financial meltdowns possible (1970s/1980s). This helps set the stage for

deregulation which eventually leads to the

dismantling of the Glass-Steagall Act and the passage of the Financial Services Modernization Act (1999)

... the financial services sectors consolidates and grows as America's symbolic economy grows in importance. The SEC begins its disappearing act.

3.

Interest Rate Manipulation / The Greenspan Put (what free market?)

...

Interest rates are used first to stabilize markets, and then as a tool to stimulate them. Bailouts and Federal Reserve money dumps begin in earnest under Alan Greenspan's leadership at the Federal Reserve. The Greenspan Put (dumping cheap money into the system when Wall Street gets in trouble) begins in 1987.

... the Federal Reserve becomes

Wall Street's support system, and then it's puppet.

... Market recklessness surges as financial services (and then gambling) grows.

4.

Yield Hunts / Secondary Markets (casino economy begins)

... Inflation + low interest rates in 1980s lead bond traders to start looking for higher yield investments.

... Non-traditional but high return investment products become more attractive, but market players are (initially)reluctant because of low bond ratings.

... Globalization (largely unregulated) allows financial firms to seek higher investments abroad through loans, secondary markets, arbitrage, etc.

5.

Bailout City (what accountability?)

... Beginning with

Mexico in 1982 (actually it begins earlier, but this is where I'm starting here), Wall Street's short sighted recklessness is bailed out time and time again. The Greenspan Put (and bailout nation) is entrenched with the 1987 rescue of LTCM.

... Accountability and free market ideology are undermined with successive bailouts and the Greenspan Put, but no one cares. Wall Street/investment bankers continue to believe in the wonders of the market.

MANIA: 1990s / Aughts ...

6.

Securitization / Derivative Markets Explode (hello Rumpelstiltskin)

... Market players become Rumpelstiltskin, and turn toxic products into gold. CDOs, SIVs, CDSs, and other novel investment products become popular, especially after ratings agencies get into bed with Wall Street's biggest investment banks.

Interconnected market players game the system.

... Wealth extraction becomes more important than wealth creation. What might have been prohibited or fraudulent before 1970 becomes the

modus operandi with favorable legislation.

... Security markets begin demanding more debt products (i.e. CDOs) to securitize, as rating companies begin to hand out AAA ratings on virtually anything that can be modeled and chopped up.

... Symbolic economy grows 30-40 times the real economy.

7.

Toxic Market "Innovations" Applauded (herd mentality for rugged individualists)

... In 2004 Wall Street (Goldman Sachs then-CEO, Hank Paulson) goes to SEC for permission to carry 40:1 debt to equity ratios (Imagine going to a bank and asking to borrow $2 million on a $50,000 a year income). In spite of opposition from Paul Volcker (Alan Greenspan's predecessor at the Fed) 40:1 borrowing ratio is granted by the SEC.

... With demand for securities growing, hedge funds,

shadow banks, and

Wall Street press Washington regulators to allow "non-conventional" lender packages into the housing market.

... Non-bank, or

shadow banks, become critical cogs in financial machine. Subprime mortgage underwriters might acknowledge but ignore all lending standards.

... With brokers dumping newly created loans 30-60 days after they're written, NINJA loans, No Doc loans, Liar loans, and other type of teaser programs become the norm.

... Caution thrown to the wind as competent regulators like

Brooksley Born are buried politically (after she called attention to disastrous derivative markets), and Sarbanes-Oxley legislation allows Washington/Wall Street to say "See, we fixed it" after Enron. Free market praised as fraud and a lack of oversight become the norm.

... Consumers borrow and use homes as ATMs, which give the illusion of prosperity.

... Personal debt climbs; the national debt doubles during the aughts; Bubbles and record profits grow.

8.

The Federal Reserve & Congress Become Cheerleaders (casino economy goes Vegas)

... Cheerleaders (who should be regulators) applaud innovative instruments and massive (unregulated) lending as evidence of the power of unrestrained markets.

... Home equity loans explode, consumption increases. Debt is the name of the game as it provides source for new securities and credit default swaps (insurance).

... Alan Greenspan cheers "new paradigm of active credit management" as

interconnected institutions and the shadow banking system sign off on new securities, mortgage back contracts, and other debt instruments/loans.

... The paychecks of those on Wall Street and in the financial services sector, plus their bonuses, shoot through the roof.

... Notional value of derivative contracts surge past $285 trillion (when annual GDP is only $14 trillion).

PAYING THE PIPER: The Mother of All Bailouts

9.

Boom / Bust / Credit Freeze (back to reality)

... What do you know? Strawberry pickers making minimum wage really can't afford $700,000 home loans.

10.

Blame Game Begins (continues today)

... Government Secured Enterprises (Fannie Mae), FHA loans, and Community Reinvestment Act (the poor) originally blamed for market collapse. Former Treasury Secretary

Hank Paulson joins the game.

... George W. Bush claims he inherited a recession, and left with a recession. A false equivalency.

... Much anticipated bi-partisan FCIC report is

blind-sided by

GOP primer that deliberately excludes any mention of

Wall Street, the

shadow banks,

interconnected cronyism, and

deregulation (all the stuff I highlighted in red above).

______________________________________

Today the too big to fail banks and Wall Street are the only ones who have access to, and are profiting from, unlimited cheap money and

our propped up casino economy. Think about it. Today the house of cards (yes, it's still a house of cards) is propped up by cheap money for Wall Street, deregulation for Wall Street, favorable legislation for Wall Street, and

adherence to a failed free market ideology that keeps the trillion dollar bailout and

QE money flowing, for Wall Street.

At the end of the day it took almost a full generation to reach our current level of market failure. Arriving at this point took the better part of 30-plus years. We're going to have to develop a better understanding of how the state creates (created) the conditions under which wealth is created if we are going to fix this mess.

- Mark

PS: Also, for my PS 404 class, I wrote about how war inspired the modern nation-state, and discuss the evolution of the modern state through the post-Westphalia, post-Napoleonic Wars, and the post Versailles periods here ...

http://markmartinezshow.blogspot.com/2013/04/war-and-markets-why-great-wealth-is-not.html