OK, I'm back ...

This was sent to me by one of my colleagues from the Economics Department. It's both funny and informative (especially if you're still having trouble understanding why we're in the economic mess we're in now). It's so clever that I've posted the entire article below. Still, here's

the link

************************************

I hate mom (and the government)

By Uwe Reinhardt

Columnist

To provide a proper backdrop for my lecture on the government's role in the economy in ECO 100: Introduction to Microeconomics, I always preface it with the question: "Who in this class has a mother?" In a good year, as much as 25 percent of students raise their hands. The rest won't admit it, probably because, with their gazillion regulations, mothers have been the biggest buzz kills to human ingenuity and innovation through the ages. Presumably the only reason these progress-stifling creatures have survived evolution is that when teenagers get into trouble, it is usually mothers to whom they run for instant succor. (For an illustration, see the

video on youtube.com of the teenager accidentally shattering a fish tank with a barbell and immediately screaming, "Mom!")

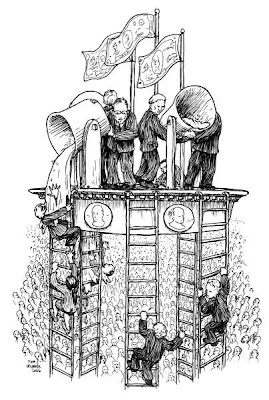

Now, what mothers are to teenagers, government is to the seasoned free enterprisers who run the private sector of our economy. When they are not being ingenious and innovative, they sit in their offices, clubs or golf carts, wringing their hands over the mindless, enterprise-stifling regulations issued by politicians and government bureaucrats who "cannot walk and chew gum at the same time." Yet, like mom-seeking teenagers, when trouble strikes, these same free enterprisers routinely run to the government for succor.

Watch, for example, as our swashbuckling, freewheeling investment bankers on Wall Street - Tom Wolfe's "Masters of the Universe" - now run to our government for socialist succor after the huge mess they have made of their companies, of our economy and indeed of global finance. One can cloak what they did in technical jargon such as "under-pricing risk." One can even write sycophantic apologias on their behalf, as New York Times columnist David Brooks did when he opined that the current calamity on Wall Street is just a byproduct of "financial innovation." The fact is that what happened on Wall Street was much less innovative than reckless and ill advised (in the vernacular, "stupid").

The bankers' new, new thing was persuading investors around the world that if dodgy mortgages - technically known as sub-prime mortgages - were packaged and repacked several times over, the risk inherent in them would somehow miraculously evaporate. By skillfully marketing that belief, they sucked sheiks in Dubai, town governments in Narvik, Norway and, ultimately, themselves into financing millions of dodgy home mortgages in the United States extended to borrowers unlikely to make the mortgage payments over the longer run.

The foundation of this game was a set of financial incentives that would have been judged misaligned by any student in ECO 100. The dodgy loans were originated by brokers who did not care about the borrowers' credit because they were paid commissions based simply on how many deals they brought to local banks, which then made the loans. The local banks did not care about the borrowers' credit either because they immediately sold the right to the monthly mortgage payments at a profit to the big banks on Wall Street. The latter bought these receivables sight unseen, usually without checking the credit standing of the original mortgagees because they made their profits by bundling tens of thousands of these dodgy mortgages to resell them the world over as "collateralized debt obligations" (CDOs), which are rights to the giant but inherently uncertain cash flows from the dodgy mortgages.

In the end, the banks even booked huge profits on repackaging their original CDOs into yet other bundles of CDOs, which were then peddled around the world as well. Evidently believing themselves that thus manure could be made to smell like roses, so to speak, the big banks invested hundreds of billions of their own shareholders' dollars in these miracle bundles, typically with borrowed funds.

Eventually news penetrated even Wall Street that millions of the dodgy mom-and-pop mortgages would be likely to default unless government came to the rescue. Once that became obvious, the CDOs directly or indirectly based on these mortgages plummeted in value, driving many heavily indebted investors to the brink of bankruptcy, among them some of the big banks. And thus we now hear from Wall Street the primeval scream "Mom! Mom!" - with "Mom" being dutifully played by former Princeton colleague Ben Bernanke of the Federal Reserve and, ultimately, the U.S. taxpayer.

We can only hope that our government's sundry Band-Aids will heal the scrapes that the bankers brought on us all. But, sadly, it is a safe bet that a year or so after the diseases have been brought under control, most likely at taxpayers' expense, the swashbuckling free enterprisers who brought on the disease will once again sit in their offices or golf carts, cursing the government and its "mindless regulations."

And therein lies the essential difference between teenagers and the seasoned adults who run the private sector. Eventually teenagers grow up to appreciate their moms.

Uwe E. Reinhardt is the James Madison Professor of Political Economy and a professor in the Wilson School. He can be reached at reinhardt@princeton.edu.