Below is an excerpt from Chapter 10 of my book, The Myth of the Free Market. In this section I explain why President Reagan's "economic successes" had very little to do with free market policies. I'm posting it (again) because when colleagues and friends have asked me about Reaganomics, they claim they can't be bothered to buy or read my book after I explain where they can learn more. So, yeah, I'm going to start e-mailing this (as you should too) to those who continue to believe in the myth of St. Reagan ...

... Upon entering the White House in 2001, the center-piece of President George W. Bush’s economic program was rooted in Ronald Reagan’s supply-side economic policies. He reasoned that by putting more money in the hands the nation’s wealthy that investments would increase, which would create more jobs and generate more tax revenue.

Insisting that the Reagan administration’s policies got the economy moving the Bush administration promised that just as Reagan saved the American economy from stagflation and misery that his tax-cutting, favor-the-rich, plan would reinvigorate the American economy. While the rhetoric was strong, a careful read of the facts illustrates that the Bush administration misread both Reagan’s accomplishments and history.

To understand what President Bush was trying to emulate in 2001 it’s necessary to recall the conditions that Ronald Reagan inherited, and supposedly tamed while in office. With inflation (12-13 percent) and interest rates (20 percent) reaching new heights in the late 1970s, and with unemployment on the rise (around 6 percent), both confidence and investment were lagging in America. The result was a new term in the field of economics and a fresh challenge in American politics: Stagflation (recession, low productivity, and inflation). By the time Ronald Reagan left office inflation and interest rates were back down to single digits, while unemployment hovered around a more acceptable 5 percent.

Because of these developments, conservatives and ill-informed talk show hosts like to claim that a combination of tax cuts, deregulation, bureaucratic reform, and assorted incentives created the environment for investment that energized the economy. Indeed, according to revisionist historians the Reagan administration was able to get America moving by reducing the size of government, cutting government spending, and getting “government off of our backs.”

This would be an interesting by-line except for one thing. It’s not true.

First, it’s interesting to note that job creation under Ronald Reagan never matched the levels achieved under Jimmy Carter, while the size of the federal government’s workforce grew from 2.8 million employees to 3.1 million.

In fact, the number of federally subsidized programs under Ronald Reagan was scaled back only to 1970-1975 levels, which helps explain why the Reagan administration hardly put a dent in the size of government.

Acknowledging this, in 1985 Fortune magazine wrote that the “budget is way out of balance because of a little-known fact: real federal spending, adjusted for inflation, has climbed even faster under President Reagan than it did in the Carter years.” In the end, in spite of what the supply-side supporters promised, the national debt almost tripled from approximately $930 Billion to $2.7 Trillion under Reagan.

So what created the conditions for the American economy to stabilize in the late 1980s, and take off during the 1990s? Primarily three factors: all of which undermine the Bush administration’s second-coming-of-Reagan claim (they also pretty much debunk the “first-coming-of-Reagan” claim too).

On the inflation front, we find that OPEC – an oligopoly that depends on cooperation to sustain itself – found its solidarity undermined by late 1981. With the beginning of the Iran-Iraq War, which Saddam Hussein initiated in part because the ayatollahs were fomenting fanatic revolution in Iraq, black markets in the oil industry grew as cheating on the part of the two combatants began (to fund their war efforts).

In addition, conservation efforts, alternative energy sources, new oil discoveries, among other developments, helped to stabilize oil prices. But these efforts were initiated by President Ford and, to a larger degree, by President Carter. Still, the reality was OPEC unity – one of the primary catalysts behind price hikes – had unraveled, while government-inspired conservation efforts paid off. As the price for oil dropped, so did inflationary pressures.

We also need to recognize a second force on the inflation front. Recall the strategy employed to control inflation was taken up by Federal Reserve Chairman Paul Volcker. In spite of pressure from the Reagan administration, who initially wanted to expand the money supply, most economists agree that by sticking to his guns, and maintaining a stringent monetary policy, Mr. Volcker helped to slay the inflation dragon. Critical here is that Mr. Volcker was appointed by Jimmy Carter, and not Ronald Reagan.

Finally, the Reagan administration’s deficit spending broke all previous records. In fact, his administration spent twice as much as the previous 39 presidential administrations combined, in the process using taxpayer funded debt to deposit hundreds of billions of dollars into the national and global economy each year. This government induced “pump priming” was an artificial stimulus – what economists call a “Keynesian stimulus” (Chapter 9) – and was hardly a vote of confidence for laissez-faire economics.

In sum, cracks in OPEC unity, conservation efforts, a tight monetary policy, and a state-led stimulus to our larger economy suggest that the Reagan administration’s policies were, at best, a supporting rather than leading factor in reversing the dismal economic environment of the 1970s.

Perhaps more importantly was how Ronald Reagan used the state to make favorable legislation for industry a standard state function, while turning hostility toward labor into a conservative virtue. Combined with record budget deficits, the Reagan years helped create an economy supercharged by deregulation and debt. But worst of all is how his policies worked to undermine the laws of justice Adam Smith argued was necessary for markets to function efficiently and equitably ...

- Mark

* You might want to send your friend this too ... "These 4 Charts Make It Clear ... President Reagan Outperformed by President Obama on Jobs, Growth, and Investment Return."

*****************

... Upon entering the White House in 2001, the center-piece of President George W. Bush’s economic program was rooted in Ronald Reagan’s supply-side economic policies. He reasoned that by putting more money in the hands the nation’s wealthy that investments would increase, which would create more jobs and generate more tax revenue.

Insisting that the Reagan administration’s policies got the economy moving the Bush administration promised that just as Reagan saved the American economy from stagflation and misery that his tax-cutting, favor-the-rich, plan would reinvigorate the American economy. While the rhetoric was strong, a careful read of the facts illustrates that the Bush administration misread both Reagan’s accomplishments and history.

To understand what President Bush was trying to emulate in 2001 it’s necessary to recall the conditions that Ronald Reagan inherited, and supposedly tamed while in office. With inflation (12-13 percent) and interest rates (20 percent) reaching new heights in the late 1970s, and with unemployment on the rise (around 6 percent), both confidence and investment were lagging in America. The result was a new term in the field of economics and a fresh challenge in American politics: Stagflation (recession, low productivity, and inflation). By the time Ronald Reagan left office inflation and interest rates were back down to single digits, while unemployment hovered around a more acceptable 5 percent.

Because of these developments, conservatives and ill-informed talk show hosts like to claim that a combination of tax cuts, deregulation, bureaucratic reform, and assorted incentives created the environment for investment that energized the economy. Indeed, according to revisionist historians the Reagan administration was able to get America moving by reducing the size of government, cutting government spending, and getting “government off of our backs.”

This would be an interesting by-line except for one thing. It’s not true.

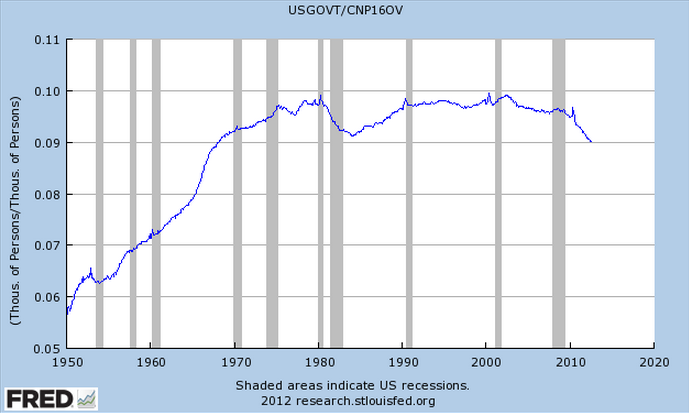

First, it’s interesting to note that job creation under Ronald Reagan never matched the levels achieved under Jimmy Carter, while the size of the federal government’s workforce grew from 2.8 million employees to 3.1 million.

|

| Job growth, by president, 1981-2015. |

|

| Public sector job growth, federal government. Note the growth under President Reagan (1981-89) and the decline under President Obama(2009- ). |

In fact, the number of federally subsidized programs under Ronald Reagan was scaled back only to 1970-1975 levels, which helps explain why the Reagan administration hardly put a dent in the size of government.

Acknowledging this, in 1985 Fortune magazine wrote that the “budget is way out of balance because of a little-known fact: real federal spending, adjusted for inflation, has climbed even faster under President Reagan than it did in the Carter years.” In the end, in spite of what the supply-side supporters promised, the national debt almost tripled from approximately $930 Billion to $2.7 Trillion under Reagan.

So what created the conditions for the American economy to stabilize in the late 1980s, and take off during the 1990s? Primarily three factors: all of which undermine the Bush administration’s second-coming-of-Reagan claim (they also pretty much debunk the “first-coming-of-Reagan” claim too).

On the inflation front, we find that OPEC – an oligopoly that depends on cooperation to sustain itself – found its solidarity undermined by late 1981. With the beginning of the Iran-Iraq War, which Saddam Hussein initiated in part because the ayatollahs were fomenting fanatic revolution in Iraq, black markets in the oil industry grew as cheating on the part of the two combatants began (to fund their war efforts).

In addition, conservation efforts, alternative energy sources, new oil discoveries, among other developments, helped to stabilize oil prices. But these efforts were initiated by President Ford and, to a larger degree, by President Carter. Still, the reality was OPEC unity – one of the primary catalysts behind price hikes – had unraveled, while government-inspired conservation efforts paid off. As the price for oil dropped, so did inflationary pressures.

We also need to recognize a second force on the inflation front. Recall the strategy employed to control inflation was taken up by Federal Reserve Chairman Paul Volcker. In spite of pressure from the Reagan administration, who initially wanted to expand the money supply, most economists agree that by sticking to his guns, and maintaining a stringent monetary policy, Mr. Volcker helped to slay the inflation dragon. Critical here is that Mr. Volcker was appointed by Jimmy Carter, and not Ronald Reagan.

Finally, the Reagan administration’s deficit spending broke all previous records. In fact, his administration spent twice as much as the previous 39 presidential administrations combined, in the process using taxpayer funded debt to deposit hundreds of billions of dollars into the national and global economy each year. This government induced “pump priming” was an artificial stimulus – what economists call a “Keynesian stimulus” (Chapter 9) – and was hardly a vote of confidence for laissez-faire economics.

In sum, cracks in OPEC unity, conservation efforts, a tight monetary policy, and a state-led stimulus to our larger economy suggest that the Reagan administration’s policies were, at best, a supporting rather than leading factor in reversing the dismal economic environment of the 1970s.

Perhaps more importantly was how Ronald Reagan used the state to make favorable legislation for industry a standard state function, while turning hostility toward labor into a conservative virtue. Combined with record budget deficits, the Reagan years helped create an economy supercharged by deregulation and debt. But worst of all is how his policies worked to undermine the laws of justice Adam Smith argued was necessary for markets to function efficiently and equitably ...

- Mark

* You might want to send your friend this too ... "These 4 Charts Make It Clear ... President Reagan Outperformed by President Obama on Jobs, Growth, and Investment Return."

/cdn0.vox-cdn.com/uploads/chorus_asset/file/2923978/dez.0.gif)

/cdn0.vox-cdn.com/uploads/chorus_asset/file/2923980/dez2.0.gif)