Could we be on the verge of another Andrew Jackson-like showdown with America’s principal money and credit institutions? I hope so. Stay with me here while I set this up . . .

UNSCRUPULOUS & HYPOCRITICAL INSTITUTIONS

With America’s financial institutions continuing to sit on trillions of dollars in bailout money, the credit card industry is now saying

they’re looking to cut $2 trillion in credit lines. It may be

happening already. This is both mind-numbing and a slap in the face to the American taxpayer.

The financial industry’s threat is a big problem, for two reasons.

First, the financial institutions that are threatening to cut credit lines are the same institutions that the federal government is bailing out – with taxpayer dollars.

Think about it. At the same time the federal government is throwing a life raft to a greedy and inept set of financial institutions – with the goal of injecting money into the system – we have Bank of America, Citigroup, and JP Morgan-Chase threatening to act like Titanic lifeboat survivors (who wouldn’t row back to save others in the water) by closing accounts, cutting credit lines, and raising interest rates (and, no, just because the credit card companies are “subsidiaries” does not make them independent firms in this mess).

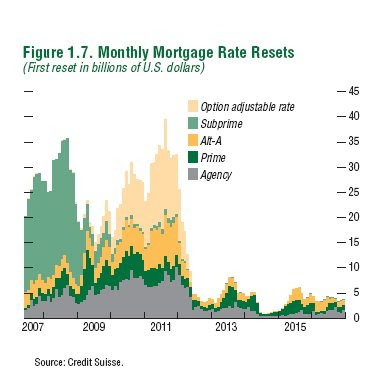

Second, credit cards are the second key source of money for American consumers, right behind jobs. Millions of Americans are up-side down on their home loans (they owe more than they're worth), and millions more will soon be unemployed.

In this environment not having access to credit will only make things worse. How bad, you ask? As Meredith Whitney, credit analyst for Oppenheimer & Co, noted, "… we expect available consumer liquidity in the form of credit-card lines to decline by 45 percent." This is akin to throwing those in the water an anchor.

The industry’s rationale is simple - and self-serving. They want protection from themselves (they don’t trust each other) and they want protection from an unemployment rate that’s expected to hit 9% (they fear future bankruptcies).

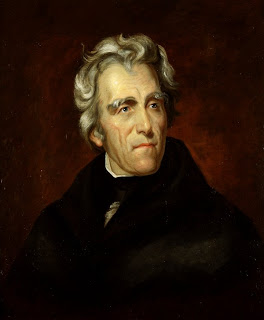

OK, now back to the Andrew Jackson-U.S. Bank showdown …

ANDREW JACKSON'S BATTLE FOR DEMOCRACY

Arthur M. Schlesinger, author of

The Age of Jackson, points out that when Andrew Jackson entered the White House (1829-1837) he was appalled by the amount of power that the premier money creating institution in the land, the Bank of the United States, had accumulated. Run by Nicholas Biddle, the Bank of the United States pursued policies that reflected his views. Specifically, the Bank of the United States operated its affairs as if it did NOT have an obligation to either the U.S. government or its citizens. The Bank’s obligations, according to Biddle, lied with its shareholders.

As a result, the Bank of the United States used its authority to create money (or “issue notes”) to speculate, to challenge the authority of the U.S. government, and to help investors and the “moneyed aristocracy” systematically exploit the “humble members of society.”

With this, the Bank’s power was at once economic, political, and social. This, in part, explains why Andrew Jackson decided to close the Bank of the United States.

Naturally, Nicholas Biddle was upset with Jackson for going after his bank. So he induced an economic panic by deliberately withholding credit between 1833 and 1834. Biddle claimed his policies had nothing to do with politics, but history (and common sense) prove otherwise. By holding the nation's economy hostage Biddle's actions also proved that Jackson was correct about the banks power, and its capacity to abuse its power.

FINANCIAL INSTITUTIONS, THEN AND NOW

This is important for us today because financial institutions are sitting on money provided to them by the U.S. taxpayer, and are now threatening to pull back on credit precisely when it is needed most. Because we have done little to curtail or regulate their power we are allowing them to act like Biddle’s bank. In fact, by providing bailout money with no strings attached, we have created a hydra-headed financial monster that President Andrew Jackson feared most of all:

an institution that could both lend and create money at will, while drawing on the resources of the state to make itself bigger and stronger.

Today, financial institutions are drawing on state resources while maintaining previous authorities and protections. In the process, they are leaving the American consumer (and taxpayer) out in the cold. Nicholas Biddle would have been proud.

Worse, the credit card industry – in Nicholas Biddle-like fashion – is now telling the world that they don’t have to maintain credit lines in spite of the fact that the U.S. government and the U.S. taxpayer are the genesis of their life support system. They must protect their shareholders first.

I say if we are going to hand over trillions of dollars to save the financial system they should be forced to help the government fix the mess they helped create. While I don’t see president-elect Obama recreating the financial system like Jackson did when he closed the Bank of the United States, he should at least pursue a Jackson-like confrontation. He should begin by forcing the financial institutions who benefit from the U.S. taxpayer bailout to renegotiate mortgage loan contracts, and/or reduce credit card interest rates.

I’ll have more to say about both of these proposals in future posts.

- Mark