This past weekend was the 10th Anniversary of the 2008 financial crisis ...

Have you ever wondered how the the financial sector cover their tracks to make their industry look good, even after their greed and stupidity helped wreck our financial world in 2008? In a few words, they use "market-speak." Check this out. Below is a paragraph that explains how the 2008 market collapse happened, from the perspective of the Bank for International Settlements (BIS). It's from their 2018 Annual Report.

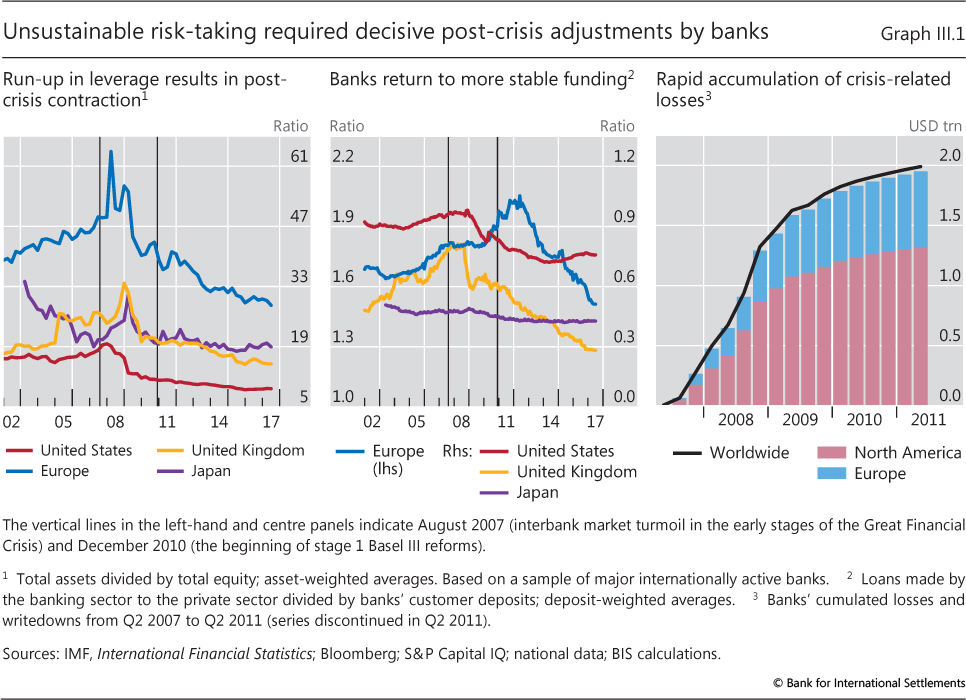

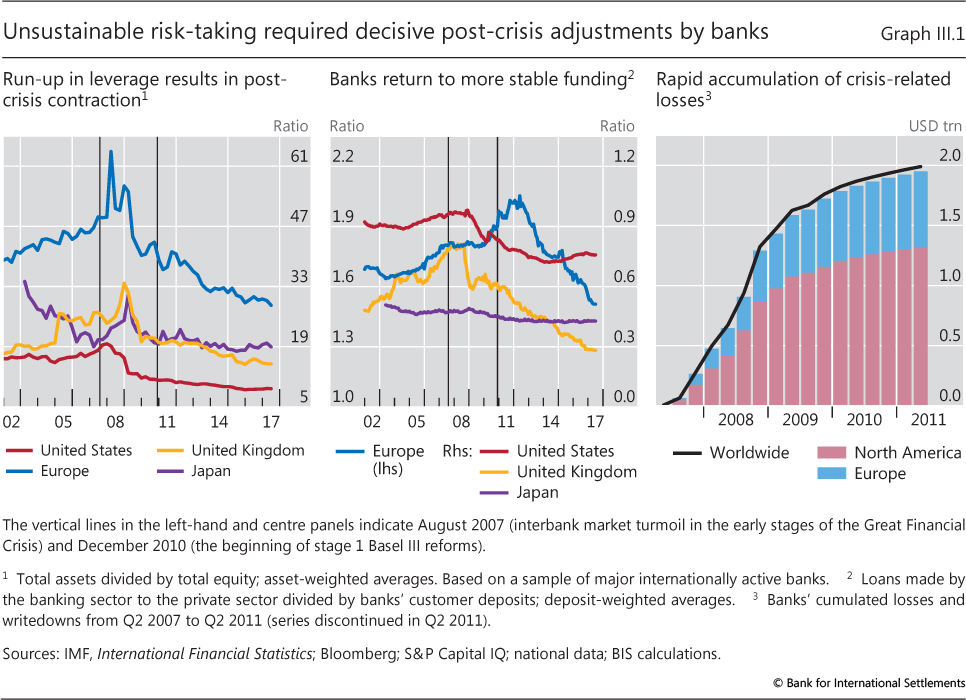

So, yeah, in a few words, the BIS paragraph above actually says a lot of stupid people made bad bets, with money they didn't actually have. But it didn't come off that way. It came off as if a "few mistakes" were made, people overreacted, but nobody's really to blame. The BIS even provided some nice charts to show people what happens when market players run amok.

If you want to read an excellent review on our post-financial crisis mindset check out Barry Ritholtz's Bloomberg article, "10 Things People Still Get Wrong About the Financial Crisis," which you can access by clicking here.

- Mark

Have you ever wondered how the the financial sector cover their tracks to make their industry look good, even after their greed and stupidity helped wreck our financial world in 2008? In a few words, they use "market-speak." Check this out. Below is a paragraph that explains how the 2008 market collapse happened, from the perspective of the Bank for International Settlements (BIS). It's from their 2018 Annual Report.

The GFC [Great Financial Crisis] laid bare the vulnerabilities of the international banking system. Major banks entered the crisis with excessive, mismeasured levels of leverage and insufficiently stable funding sources. Crisis-related losses accumulated rapidly, contagiously spreading across markets and countries, and forcing public sector intervention. What started as strains in US subprime mortgage markets turned into a full-blown financial crisisIf you're like most people, you're probably thinking, "What the heck did they just say"? Here's what the paragraph actually says:

Before the 2008 market crash, stupid and greedy market players in a recklessly deregulated market environment made numerous bad bets with money they didn't really have, and then backed these bets with "insurance" that didn't really exist. When the market collapsed they lost their bets, panic ensued and market players needed a multi-trillion dollar bailout backed by the American taxpayer. What started as a lot of bad bets, with no collateral or funds to back up the bets (especially in the U.S. housing markets) turned into a full-blown financial crisis.See the difference?

So, yeah, in a few words, the BIS paragraph above actually says a lot of stupid people made bad bets, with money they didn't actually have. But it didn't come off that way. It came off as if a "few mistakes" were made, people overreacted, but nobody's really to blame. The BIS even provided some nice charts to show people what happens when market players run amok.

If you want to read an excellent review on our post-financial crisis mindset check out Barry Ritholtz's Bloomberg article, "10 Things People Still Get Wrong About the Financial Crisis," which you can access by clicking here.

- Mark

No comments:

Post a Comment