Monday, December 30, 2013

Saturday, December 28, 2013

READING FOR THE LAST WEEKEND OF 2013

Another rich entrepreneur makes it clear, rich people don't actually "create the jobs" (Business Insider / Henry Blodget).

Racist school teacher tells an African-American student he can't become president because America doesn't need another black person in the White House (Raw Story).

Albert Einstein's one page explanation on the importance of unions (University Professional & Technical Employees).

Two years after she passed away, a woman gives her family an unforgettable Christmas gift (Buzz Feed).

FROM NEANDERTHALS TO ...

Beyond neanderthals ... The case of the missing ancestor (National Geographic).

Speaking of neanderthals ... Pastor John Hagee has a message for the atheists (Raw Story).

... THE CHRISTIAN RIGHT

The right wing is filled with biblical illiterates: They'd be shocked by Jesus' teachings if they ever picked up a Bible (AlterNet).

Jesus was a liberal: 15 quotes the 'Christian' right doesn't want you to see (Addicting Info).

How to expose the hypocrisy of the religious right (Addicting Info).

The Pope's economic ideas rattle the GOP (Politico).

BY THE NUMBERS

I like this list ... the Top 10 Villains of 2013 (Raw Story).

The 10 dumbest dumb dummies of dumb crime in 2013 (Huffington Post).

The 10 most powerful militaries in the world (Business Insider).

The earth's next 100 years visualized (Upworthy).

MISCELLANEOUS

Snowmen that would make Calvin and Hobbes proud (Huffington Post).

The short animated video from Ed Asner that Republicans hate (Move On).

Diebold charged with bribery, falsifying documents, and "worldwide pattern of criminal conduct" (Salon).

Utah is on track to end homelessness by 2015 with this one simple idea (Nation Swell).

Here's an idea ... Why don't we pay back the money we borrowed from social security instead of making cuts to continue funding tax cuts for the rich (Huffington Post).

- Mark

Friday, December 27, 2013

OUR OBSTRUCTIONIST "DO-NOTHING" CONGRESS

Just how pathetic was our U.S. Congress this past year? See for yourself ...

Oh, and let's not forget the record number of filibusters which actually blocked actions that would have passed ...

- Mark

Oh, and let's not forget the record number of filibusters which actually blocked actions that would have passed ...

Thursday, December 26, 2013

WHY POLITICS NEEDS SCIENCE ...

Via Upworthy we get this clip from Carl Sagan. More than 17 years ago he explained why we need science and the scientific method in our political process. His prediction not only nails it, but it helps to explain what we're experiencing in our political arena today ...

If you want to know why we need to listen to the scientists on things like global warming the scientist in this video clip uses a very simple analogy to help us understand what's happening in our world ...

With forced sequestration cuts leading to layoffs throughout the scientific community - and budget cuts to the National Institute of Health (5.5%) and the National Science Foundation (2.1%), in spite of what was requested - we are not doing ourselves any favors over the long term.

- Mark

Tuesday, December 24, 2013

IT'S A REPUBLICAN CHRISTMAS ... THEIR "TO DO" LIST

'Twas the night before Christmas, when all through the house, not a creature was stirring, not even a mouse ... except for the cold-hearted Grinches of the Republican House. Specifically, they've been busy with these stocking stuffers ...

Check, check, check, and check.

There you have it. A Republican Christmas.

- Mark

Check, check, check, and check.

There you have it. A Republican Christmas.

- Mark

Monday, December 23, 2013

MIKHAIL KALASHNIKOV, INVENTOR OF THE AK-47, PASSES AT 94

From the Russian Times we learn that Mikhail Kalashnikov, inventor of the AK-47, has died. The AK-47 is the most popular gun in the world, and was even used by U.S. troops in place of issued M-16s in Vietnam after they grabbed them from captured or killed Vietnamese.

If you're interested in reading about the inventors life story and the AK-47 Mikhail Kalashnikov's "The Gun That Changed the World" is an accessible and quick read. I read it about 5 years ago.

A few words on the gun ...

- Mark

If you're interested in reading about the inventors life story and the AK-47 Mikhail Kalashnikov's "The Gun That Changed the World" is an accessible and quick read. I read it about 5 years ago.

A few words on the gun ...

- Mark

TEA PARTY PARADISE ... SOMALIA

After the failure of the Articles of Confederation the Founding Fathers learned a big lesson. They learned that a weak central government was actually a bad idea. So they put some teeth into our federal system of government.

Unfortunately, today there are many who believe that they have a better understanding of our history and government than America's Founding Fathers. They want to dismantle the American government as we know it, and replace it with a "libertarian paradise" that they naively believe could work because people are just, you know, so nice and cooperative.

What they don't understand is what happened the last time we tried what they're suggesting (under the Articles of Confederation) and what life would be like if they got their way ...

Yeah, apart from being constitutional illiterates - the Articles of Confederation IS part of our constitutional history - many on the far right really have no idea what happens when government doesn't work.

Here's a humorous take on what life would be like if we follow the lead of the Tea Party and the Libertarians in America ...

And, yes, the Founding Fathers thought about what the Libertarians and the Tea Party extremists are talking about today. If they ever bothered to pick up and read the Federalist Papers they would know this.

I think I'll leave it at that, for now.

- Mark

Unfortunately, today there are many who believe that they have a better understanding of our history and government than America's Founding Fathers. They want to dismantle the American government as we know it, and replace it with a "libertarian paradise" that they naively believe could work because people are just, you know, so nice and cooperative.

What they don't understand is what happened the last time we tried what they're suggesting (under the Articles of Confederation) and what life would be like if they got their way ...

Yeah, apart from being constitutional illiterates - the Articles of Confederation IS part of our constitutional history - many on the far right really have no idea what happens when government doesn't work.

Here's a humorous take on what life would be like if we follow the lead of the Tea Party and the Libertarians in America ...

And, yes, the Founding Fathers thought about what the Libertarians and the Tea Party extremists are talking about today. If they ever bothered to pick up and read the Federalist Papers they would know this.

I think I'll leave it at that, for now.

- Mark

READING BEFORE CHRISTMAS (12-23-13)

The year in photos (The Atlantic).

The weirdist stories of 2013 (Huffington Post).

Dealing with the haters out there (Bob Lefsetz / The Big Picture).

Wildly expensive athlete divorces (The Postgame).

Words you shouldn't use if you want your resume to standout (Women's Health Magazine).

POLITICS IN AMERICA

Ohio state Senator Nina Turner introduces bill to regulate reproductive health of men (ABNews).

Obama jabs Putin, picks openly gay delegates for winter Olympics in Sochi, Russia (Huffington Post).

THE WORLD OF BANKING & FINANCE

Half-Assed ... or "Why the Banks Get Away With the Crap They Get Away With" (Cassandra Does Tokyo / The Big Picture).

Seriously, there is no functioning free market ... Here's a long list of market manipulation from the banks, financial institutions, and just about anyone who has the cash to move markets (Zero Hedge).

This is why people will begin rebelling around the world ... the Spanish government is preparing another bailout for billionaire oligarchs (Liberty Blitzkrieg).

MISCELLANEOUS

The seven best speeches in TV history (Huffington Post).

14 services for the super rich you never knew existed (Daily Finance).

What shoddily made bridges say about China (Global Post).

Shanghai's record pollution is now creeping inside building (Zero Hedge).

- Mark

Sunday, December 22, 2013

MINIMUM WAGE AND AMERICA'S MIDDLE CLASS

Among the Organization for Economic Cooperation and Development (OECD) countries in 2013 New Zealand, the United States and Denmark are ranked 1, 2, and 3 when it comes to the "ease of doing business" by the World Bank. When it comes to hourly minimum wages New Zealand pays $11.27 per hour (NZ$13.75), the U.S. pays 7.25, while Denmark pays about $19 (the OECD numbers differ slightly here).

The point of bringing up these numbers is to make it clear that the U.S. can begin thinking about raising the minimum wage without having to deal with the absurdly ridiculous claims that the economy will go into a tailspin if we do. Perhaps more importantly the U.S. can begin putting a dent into the millions of working poor Americans who must apply for public assistance just to make ends meet (McDonald's employees receive about $1.2 billion in public benefits every year).

There's much more to the minimum wage story. In fact, raising the minimum wage is just one part of a larger economic problem we have in the U.S.

As I've pointed out before ...

* Hostility towards unions and labor, favorable legislation for industry, and policies that encourage and even rewards companies to take higher paying jobs overseas (outsourcing) do little to help Main Street.

* Then we have cutbacks in programs for job training and worker education that needs to be addressed.

* Perhaps even more depressing is how we encourage a form of parish serfdom by allowing big firms like Wal-Mart to game a system that subsidizes their profits by making public assistance available to full-time workers who don't earn enough to make ends meet.

In all, minimum wage is just one part of a larger national problem that encourages an economic race to the bottom that hurts not only American workers, but America itself. If you're interested in reading more on the topic the links below are helpful.

* The number of renters paying more than 30 percent of their income reached another high in 2012, with more than half saying their budgets are stressed by high rents (Harvard University).

* Fast-food wages come with a $7 billion side of public assistance (Bloomberg).

* One third of all bank tellers rely on government assistance (Bloomberg).

* What a higher minimum wage does for workers and the economy (Bloomberg).

- Mark

Thursday, December 19, 2013

Wednesday, December 18, 2013

ECONOMISTS, THE NOBEL PRIZE AND THE REAL WORLD

I recently got into an exchange with a conservative friend on Facebook. He decided that economists John Maynard Keynes, Paul Krugman, and the "science" part of political science were not worthy of being taken seriously. Actually, it wasn't much of an exchange once I made it clear to my friend that his assertions were rooted in his general ignorance about the social sciences and the scientific method.

What my conservative friend thought he was trying to tell me is that the hard sciences (physics, biology, etc.) are the only disciplines where we can find real answers. Then, losing sight of his suggestion that the social sciences aren't scientific, he claimed that his economists - Milton Friedman, Friedrich Hayek, et al. - are the only social scientists that we should follow because, you know, they're real scientists. Huh?

If my friends logic seems confused that's because it is. So, let's recap.

For my friend economists John M. Keynes, Paul Krugman and the discipline of political science aren't scientific enough, and shouldn't be taken seriously. His economists and his political beliefs, however, are the real thing. Ergo, everyone should listen to him.

Since it was obvious that my friend didn't really understand what science entails I decided to expose the absurdity behind his claims. It was fun, which is why I'm sharing the discussion below (with a few edits).

****

To begin with, the "science" in political science, or any other science for that matter, lies in the method, not in the certainty of outcomes. Those who found cures for influenza did not find answers the first (or the second, or the third, or ...) time around. They found cures using the same painstaking processes that eliminated confirmation bias and false positives, among others.

It's the methods used that make the social sciences - and the hard sciences - scientific. There is no escaping this.

Whether you're trying to understand how markets behave so you can make investment decisions, or are trying to understand the causes for war so you can reduce the proclivity towards it, there is a certain process that you must follow (as I discuss here). A good political scientist, for example, can explain to you the causes for war and the characteristics behind empire cycles, for example, but we can't tell you exact dates when wars will start, or when the American empire will end in the future (and it will).

Political science, like all social sciences, is not an exact science. But we also want to keep in mind that, in spite of incorporating more math into the discipline, the field of economics is not an exact science either. It never has been.

So, if you have a friend that likes to claim that Friedrich von Hayek and Milton Friedman - or any other economist for that matter - offers irrefutable evidence of how the world works (or should work) let them know that their arguments can be debunked with good counter arguments. In fact, here are a few good counter arguments for your Milton Friedman fans (in the FYI category, the arguments of Ayn Rand, who was no economist, are based on pure fantasy).

To give you an example of how unscientific the field of economics is let's think about the Nobel prize in economics (a farce if there ever was one).

The Nobel committee has given the Nobel prize, in the same year, to economists who made opposing arguments about the same economic phenomenon. Twice.

Can you imagine two geologists getting the Nobel prize, one for explaining the logic behind tectonic plates and the other for explaining God getting mad at America's lifestyles and causing earthquakes?

Can you imagine two geologists getting the Nobel prize, one for explaining the logic behind tectonic plates and the other for explaining God getting mad at America's lifestyles and causing earthquakes?

I agree. It's an exaggerated example, but you get the point. Economists are social scientists who disagree about so many things that claiming absolute certainty for their findings is pure fantasy, especially if you don't incorporate what the political scientist - and other social scientists - have to say on the issues they study (which is what makes Keynes, and now Krugman, superior on these matters).

So, yeah, economist Friedrich von Hayek and Milton Friedman may offer us evidence of their findings. But being economists does not necessarily mean that what any economist has to say explains the real world any better than a political scientist or a political economist.

The Nobel prize in economics does nothing to alter this reality.

So, yeah, economist Friedrich von Hayek and Milton Friedman may offer us evidence of their findings. But being economists does not necessarily mean that what any economist has to say explains the real world any better than a political scientist or a political economist.

The Nobel prize in economics does nothing to alter this reality.

- Mark

FYI Category: In 1974 Sweden's Gunnar Myrdal (planned economies) and Austria's Friedrich von Hayek (free markets) won the Nobel Prize in spite of making opposing arguments about markets. Most recently Gene Fama (stock prices reflect worth, or real value) and Robert Shiller (stock prices reflect confidence, and psychology) became Nobel laureates in spite of telling us two entirely different things about stock prices.

Saturday, December 14, 2013

READING FOR THE WEEKEND (12-14-13)

Tale for the season(s) ... Man commits suicide after spending five hours shopping with girlfriend, who wanted to continue shopping (Gawker).

The Veterans Administration lobotomized 2,000 "disturbed" military veterans immediately after WWII (Army Times).

Former FBI agent missing in Iran was a CIA agent working an unauthorized mission (The Guardian).

The bubonic plague kills 20 villagers in Madagascar (The Guardian).

Uruguay just became the first country to legalize the marijuana trade (Business Insider).

THE REAL PRICE OF OUR GROWING NATIONAL SECURITY STATE

Bill Moyers: "We are this close to losing our democracy to the mercenary class" (Alternet).

The over policing of America (Nation of Change).

Intelligence contractors donate millions to intelligence committee members in congress (Center for Public Integrity).

A coalition of the world's largest tech giants - Google, Apple, Yahoo, Facebook, and Microsoft - have gotten together to ask that the United States reform its sweeping surveillance programs because the U.S. government's demands, ultimately, are bad for business (Reform Government Surveillance).

ECONOMICS & FINANCE

More news on Detroit's bankruptcy (Nation of Change).

The "Raise the Minimum Wage" argument is not so simple (The Atlantic).

The most important economic stories of 2013, in graphs (The Atlantic).

Five years later U.S. households haven't recouped financial losses from crisis (Nation of Change).

I've always liked this guy ... David Stockman, former Director of the Office of Management and Budget, is pretty clear: "Valuation has lost any anchor to the real world" (Zero Hedge).

"OOPS, MY BAD ... BUT IT'S GONNA HAPPEN AGAIN"

Fifteen people on their way to a wedding in Yemen were killed by drone strike when their party was confused for an al Qaeda convoy (RT).

In a related story, U.S. military changes drone rules to make targeting of civilians easier (Zero Hedge).

The California State Supreme Court declines to hear a case on predatory lending against Wells Fargo. One judge, who owns at least $1 million in Wells Fargo stock, fails to remove herself from the case. Weak disclosure laws make this a common occurrence across the country (Center for Public Integrity).

BY THE NUMBERS

Six of the top ten billionaires in America are the Koch's and the Walton's (Truth Out).

Ten small great cities for retirement (AARP).

The #1 reason why women over 50 cheat. It's not what you think (AARP).

The ten worst economic predictions, ever (Zero Hedge).

- Mark

INCOME GAINS IN AMERICA, 2002-2012 ...IN CASE YOU FORGOT

The latest numbers on income gains between 2002 and 2012 from UC Berkeley's Emmanuel Saez ...

And, no, the bottom 90 percent - who saw their share of income decline by 10.7 percent - didn't come close to keeping up with inflation.

- Mark

And, no, the bottom 90 percent - who saw their share of income decline by 10.7 percent - didn't come close to keeping up with inflation.

- Mark

Thursday, December 12, 2013

FROM BAIL-OUTS TO BAIL-INS ... TIME TO MOVE YOUR MONEY?

Most of you have heard of bail-outs. Simply put, when a financial or industrial group is about to close their doors because of mismanagement or bad luck the state steps in to bail-out both the company (or companies), and their shareholders. The U.S. government did this with Wall Street in 2008.

With Wall Street sitting on another bubble in 2013 talk in some circles has moved from traditional bail-outs to bail-ins. Just what are bail-ins, you ask? Good question. Let's use the banking industry as our example.

In real simple terms, rather than using taxpayer backed money to bail-out the banks the federal government would force bondholders or depositors to cough up the money to save a failing institution. So, yeah, the banks would get a shot at picking your pockets.

Rather than a government bail-out we get a bail-in from those who have a stake in the bank.

One famous bail-in happened in Cyprus last spring. Depositors were forced to contribute part of their deposits to bail-in the banks where they deposited their money. To be sure, those hurt the most (in terms of money lost) were the Russian oligarchs who were using Cyprus banks to launder money and avoid paying taxes in Russia. But the reality remains, other depositors got caught up in the bail-in too.

Could it happen here, in the United States? That's a good question. Especially since it's happened - or is being discussed - in other countries (beyond Cyprus).

In a few words, yes, forced depositor bail-ins could happen here (as Zero Hedge points out). This is especially the case if the Bank for International Settlement's Basel Committees recommendations in 2010 (p. 23, 43) and 2013 are taken up. Both reports make it clear that leaning on federal deposit insurance should be considered, after the next collapse, as part of a larger strategy for saving the banks (if it's insured by the Feds, why not take it, right?).

But wait, it gets better. Apart from the Basel Reports' recommendations, the FDIC and the Bank of England are already lining up the legal framework that will frame such a bail-in scenario.

|

| "Uh ... make that a 'bail-in'! |

There's more to the story. And nothing is concrete, yet. But know one thing. Bail-ins will be considered for America's largest banks when our next financial collapse happens.

- Mark

If this concerns you at all you might want to take a look at the Move Your Money group, which I posted on here almost four years ago.

UPDATE: I'll discuss what virtual money and Bitcoins means for our economy and society next week.

Wednesday, December 11, 2013

POPE FRANCIS & TRICKLE DOWN ECONOMICS

Pope Francis on inequality and trickle down economics ...

And while we're at it, Mark 10:25 (or Matthew 19:24)...

- Mark

And while we're at it, Mark 10:25 (or Matthew 19:24)...

"It's easier for a camel to go through the eye of a needle than for a rich person to enter the Kingdom of God."

- Mark

WHAT'S IN A HANDSHAKE?

After the right wing media noise machine, no doubt, gave them their marching orders my conservartive friends on Facebook are bringing up President Obama's handshake with Raul Castro (for no reason at all). So let's put some perspective on the topic ...

As long as we're talking about handholding protocols ...

- Mark

As long as we're talking about handholding protocols ...

- Mark

Tuesday, December 10, 2013

THE GHOST OF 1929 - AND THE POLTERGEIST OF 2008 - WILL REAPPEAR

From MarketWatch we get two charts that are - if we are to believe the headlines - "scaring" Wall Street. One tells us what happened with the Dow Jones during the year and a half before the market crashed in 1929. The second chart tells us what's been happening with the Dow Jones over the past year and a half ...

See any similarities?

Still, author Mark Hulbert tells us that we really shouldn't be concerned with these almost mirror-like graphs. There could be any number of reasons for the similar patterns we are seeing over an 18 month period. Just as well, according to his market analysts, we should be fine as long as we "diversify" our investments, take a look at "absolute-return strategies" and keep in mind that market performance is based on a number of factors, which include expenses, liquidity etc.

Yawn. In fact, make that a double yawn. Count me as unimpressed with these "nothing to worry" scenarios. Here's my problem with the expert analysis.

If all these market gurus can say about our current market is not to put all your eggs in one basket, don't worry about what's happening in other markets, and to be sure to do your homework, I want my money back.

Keep in mind that the people Hulbert cites get paid for sounding impressive about market developments. Perhaps more importantly, Hulbert's experts get paid for keeping people tied into the market, which means they're almost obligated to say "Don't worry about a thing. Just follow our market reports and our advice, and everything should be fine. Trust us."

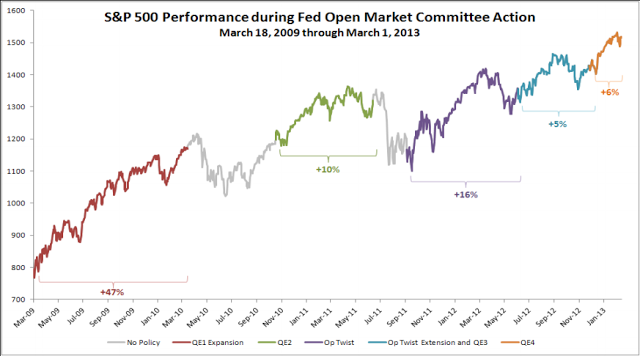

The reality is that our markets are not fine. They are afloat and hitting record levels only because of the trillion dollar money dumps from the Federal Reserve, favorable legislation, and on-going deregulation. That's it.

Diversification strategies, staying in one industry, and doing your homework won't help one bit if there's no money in the system. Seriously. It's why we initiated the Quantitative Easing (QE) financial gravy train in the first place. Any talk about what's driving market performance that doesn't start with market bailouts, QE Eternity, and deregulation is not market analysis.

They are simply the words of a bloviating ignoramus.

As I've pointed out before, there is a strong correlation between the bailouts and what's happening in our markets today. When the bailouts and easy money stop - and they will - the ghosts of 1929, and the poltergeist of 2008, will reappear.

This isn't rocket science.

- Mark

Saturday, December 7, 2013

THE MORAL JUSTIFICATION OF CAPITALISM IS ON THE ROPES ... HERE'S WHY

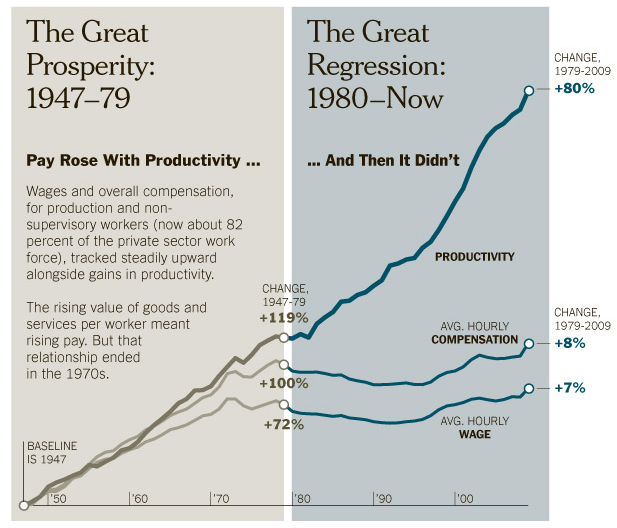

Unfortunately, since the mid-1970s the moral justification of capitalism in America has slowly begun to disappear. In very simple terms, while productivity and national income has surged wages and benefits have effectively stagnated for the middle class.

What this means in lost wages and collapsing purchasing power for the average American worker, and America's middle-class, is staggering.

Let's assume that you are making $637 per week in 2013. Now consider this. If wages and benefits had kept pace with the amount of goods and services that you and every other American worker has helped produce over the past 40 years you would be earning almost $1,200 per week!

Put another way, wages in America have not kept pace with rising productivity and, in some cases, have even fallen. The result of stagnating wages in America has been rising debt loads which has the American consumer on the ropes. As I pointed out here 10 months ago:

Another way to think about all of this is to think of credit card use in historical terms. If we take what all Americans owed to the credit card industry in 1969 and average it we learn that each household owed $37 in credit card debt. If we do the same thing for 1980 we find that each household owed $670. By 2010 the average household owed $7,800 (but slightly less in 2012).

But wait, it gets worse. While total consumer debt in America has declined by $100 million since 2008, collectively we still owe $11.4 trillion - with over $1 trillion of this amount considered delinquent. All of this helps explain why bankruptcy filings in America has averaged about 1.3 million a year since 2003.

At the end of the day, the American worker is treading water financially and effectively tapped out.

The point here is to let you know that as our nation's economic pie has grown - and it has grown significantly - America's middle-class is no longer sharing in the fruits of our nation's growing economy, as was the case between 1945 through the mid-1970s. People are working just as hard, or harder, than they were twenty years ago but they are not getting ahead.

With stagnating wages and growing debt loads it's clear that the moral justification of capitalism in America is clearly in trouble. And if it's in trouble America is in trouble. If we are going to properly address this new American reality - assuming that we want to - we need to understand one thing: Why it's important that everyone who works hard has a legitimate shot at getting ahead.

A little bit of history is helpful here.

BEFORE THE MORAL JUSTIFICATION

Feudal and imperial societies from the past are examples of social orders that did not systematically reward hard work or provide opportunities for advancement. Worse, these societies would regularly grant special privileges to aristocrats, the clergy, and to royal family members.

Apart from being burdened by custom, tradition, and foolish superstitions these pre-modern systems were rigged with tax exemptions and legal codes that rewarded the noble airs and established positions of societal elites and their sycophantic courtiers. In a few words, opportunity and reward were only available to those with access to palace networks (elites), social position (the military and the church), or bloodline (aristocracy and monarchies).

Opportunities and market rewards were even more elusive if you were a woman.

In all, up to 90 percent of those living in pre-19th century societies were largely condemned to the low social positions they were born into.

The unwillingness of monarchs and aristocratic tyrants to correct these inequities with systems of education, equal protection under the law, or by providing sufficient aid to the poor who were condemned to servitude in perpetuity undermined both opportunity and reward. Worse, gaps in wealth and justice were viewed as the natural order of things because, if you listened to the elites of the day, not only did God want it that way but your reward would come in the afterlife.

Before 1776 virtually every society ignored the imbalances and misery that made up the reality of feudal societies around the world. The result was that those who led precarious lives and worked the hardest before the modern era could not reap the fruits of their labor.

Because of a revolution in thinking, and developments in the New World, this situation would begin to change by the 18th century.

ROOTS OF THE CAPITALIST REVOLUTION

Once the Enlightenment began producing learned scholars and critics who questioned the status quo our political and economic world began to change. The idea that people should be free to choose what they wanted to do with their lives both politically and economically put a primacy on creating a system of opportunities for the common man.

Indeed, the primary goal of the American Revolution was to rid the continent of an antiquated imperial system that supported Britain's privileged elite, but restricted the opportunities and rewards available for those in America. Tired of being told what to produce, and on whose terms their goods could be shipped, the primary goal of the America's Founding Fathers was to create a constitution that would guarantee and open up opportunities for the common man in America (as long as you were a white male).

What set the stage for promoting opportunity and reward were ideas about human dignity and personal freedom, which had percolated down from the Renaissance, the Reformation, and the Enlightenment.

These ideas, coupled with the American Revolution would help inspire political upheavals and the liberal constitutions that swept through Europe and Latin America during the 18th and 19th centuries.

Led by the American and French Revolutions, the new social orders - and the new social contracts - that were created released large segments of society from the shackles of feudalism. Dynamic checks and balances replaced stifling customs and traditions. The result was that talent and merit, rather than social position and bloodline, became dominating features of the modern world.

Individual liberty, then, was not just a rallying call for removing the British, and other imperial states. Liberty was necessary to establish both opportunity and the rules behind our new political and economic systems. Being free to choose who would rule over you, and having the liberty to determine what you wanted to make of your life, meant opportunity and reward were built into our new liberal constitutions (again, women, people of color, and indigenous cultures were left behind).

Democracy and free markets were the result.

But just as democracy had its fits and starts (especially with women and Black Americans disenfranchised), a funny thing happened on the way to the market economy that we enjoy today.

FREE MARKETS WITH FEW OPPORTUNITIES, AND NO MORAL COMPASS

Today we know that opportunity and market rewards in the past were undermined by feudal customs, traditions, and entrenched privileges. Fraud and political schemes would also worked to undermine opportunity and market reward, as it does today (more on this below).

While the penchant to defraud and scheme appears to be a human constant, the moral justification of capitalism in post-colonial America was also undermined by our societies new customs and beliefs. Specifically, slavery and social mores would turn blacks, women, and even children into second class citizens as a matter of course.

Ascribed gender roles, slavery, and simple ignorance not only torpedoed the earning capacity of these groups, but they robbed women, children, and generation after generation of blacks in America of an opportunity to earn and accumulate wealth.

While many used tradition, the Bible, and even junk science to justify ascribed gender roles, exploitation, slave markets and, later, even Jim Crow, one thing was very clear: Free markets in America developed and prospered with no moral compass, and with few opportunities for a large segment of the population.

The reality is that wages and wealth accumulation in the United States were skewed to favor white males. Their accomplishments and market rewards in the 18th and 19th centuries, which are often attributed hard work and business acumen alone, is a misleading story line.

Their successes were made possible by a set of rules that made it clear that white males were privileged and protected by custom and law.

White males did not have to worry about competing against more than half the population because opportunities for women to compete on a level playing field were denied. Nor did white males have to worry about competing against black Americans. Slavery and, later, Jim Crow took care of this. The legal and social exclusion of more than one-half of America's workforce from the marketplace was the ugly reality of America's "free market" system.

Adding to these free market realities was the prevalence of child labor. Unable to escape the feudal notion that children should contribute to the family’s well-being (an accepted practice as long as we're talking about herding sheep, or caring for a sibling on a farm), children were put to work in factories and mines at the beginning of the industrial revolution.

The moral questions of child labor were famously raised by Charles Dickens in Oliver Twist, and, later, chronicled by E.P. Thompson’s The Making of the English Working Class (1963). Still, during the initial stages of industrialization many argued that children were “free agents” capable of negotiating salaries and work conditions on their own behalf.

But what chance did a 12 year old child working in the mines have? Uneducated and often frail, children had few skills, and even fewer options.

For most hard working women, children, and people of color in 19th century America opportunity and reward were elusive, at best. Put more simply, the moral justification of capitalism in America did not exist.

Progressive political movements would slowly push "the state" to change this reality.

FULL OPPORTUNITY AND REWARD ARRIVES IN AMERICA (kind of)

For many it’s tempting to say, “That’s just the way things were. Those who did compete still found an unrelenting system that fostered the ‘survival of the fittest’ mentality. These people were ‘survivors’ in the Darwinian sense …”. While this may be true it also ignores the logical follow-up: Those who participated and prospered in eighteenth and nineteenth century America did so in a system that systematically bottled up the prospects of more than one-half of society.

Put another way, the game was rigged, and the benefits flowed one way.

As such, we can’t attribute great success, wealth levels, and pay disparities in America after the American Revolution to efficient capitalist market forces. The analysis is incomplete. We have to acknowledge that well over one-half of America's population could not compete on a level playing field during the first 175 years of America's existence.

What this means is that the moral justification of capitalism is not simply a function of freedom, or saying we have open markets and free trade. The state has had to step in and make sure that those who work hard are not excluded from the rewards and opportunities available to others. Being rewarded with fairly negotiated wages and benefits doesn't just happen because you have a competitive market environment where goods are bought and sold.

The American experience makes this clear on so many levels.

Slaves and people of color needed a civil war and a civil rights movement to gain access to market rewards. Women and children needed social justice and legal protections to find their opportunities in the workplace and through education. There were no “invisible hands” involved in making market opportunities available to all. The state had to force the issue.

Today, the scourge of child labor, Jim Crow and gender bias have been dealt with on many levels in America. It's not fixed, but it has been dealt with. Still, other factors continue to eat away at the moral justification of capitalism today.

WHY "THE MORAL JUSTIFICATION ..." STILL NEEDS WORK

One way to stack the deck for, and against, certain groups is to use political institutions to secure favors. This is happening today in America. Favorable legislation, government subsidies, market protections, stacked regulatory agencies, government supported attacks on labor, tax burdens shifted to the middle class, and regular industry bailouts are all examples of this.

But this shouldn't come as a surprise. The intellectual godfather of capitalism, Adam Smith, understood that the state would pick favorites. This is why he made it clear that there should be minimal government intervention in the marketplace. It's not to allow market players to do what they want, as many misinformed pundits and politicians like to claim, it's because - as Smith pointed out - government usually intervened on behalf of those with power and privilege.

When this occurs, the reward and incentive system is just as skewed as it was when child labor, Jim Crow, and ascribed gender roles were the order the day. While favorable legislation may not be as socially demeaning as gender bias or Jim Crow, the economic effect is similar: Market rewards are unduly skewed, while opportunities are compromised.

As long as bailouts, artificially cheap money, and favorable legislation that comes in the form of market protections are the order of the day in America - and it is - it's impossible to speak glowingly of free markets and capitalism in America today.

I'll go one step further. The way the system has been rigged to favor Wall Street over Main Street, the United States does not have a functioning free market system.

WHY THE RIGHT IGNORES WHAT MAKES THE "MORAL JUSTIFICATION" TICK

Market achievements and individual success in America - past and present - owe a great deal to state sanctioned discrimination and social injustices. Simply put, when the government ignores, encourages, or winks at a way of life that helps determine who emerges at the top of our economic food chain the moral justification of capitalism is diluted, if not entirely broken.

This is the case in America today.

We need to acknowledge that financial success in our modern markets has always been influenced by favorable legislation, demeaning stereotypes, and social beliefs that cheapen us all. The notion that “hard nosed” business decisions are what made America and what drives market success is a myth.

Many politicians and pundits today like to downplay (or ignore) the role the state plays in making markets work. They prefer, instead, to put their faith in an incomplete understanding of “markets” and free trade that is based more on myth than historical fact. They do this because it helps inflate their own sense of who they are, especially if they have lots of money.

The reality is the state creates the conditions under which wealth is created. It always has.

Unfortunately, most market observers don't understand any of this. Like Galileo’s colleagues, who were afraid to look in his telescope for fear of what they might see, many laissez-faire market proponents do not want to look at (or acknowledge) the role of the state in making markets work.

In terms that Galileo would understand, having to acknowledge the role of the state in setting the table for wealth creation would turn their very linear and flat world round, which would make it much more complex.

But their reluctance to look through the "state" telescope is understandable. Many people are comfortable only in the world they know. This explains why the beneficiaries of inheritances, family networks, transferred property, and market windfalls made possible by favorable legislation and bailouts would rather believe that their wealth is a product of their acumen and hard work alone.

It reaffirms their belief that individual fortunes are evidence of individual strength and market accomplishments.

This is a myth.

Those who are making a fortune on Wall Street - while benefiting from U.S. tax payer backed bailouts, artificially cheap money, and favorable legislation - don't want anyone looking behind the capitalist curtain that surrounds their achievements. What they fear is what the rest of us already know. Our current legal system and modern moral code not only makes their kind of wealth possible but - as French economist Frederic Bastiat (1801-1851) might have suggested - it glorifies the end result, no matter what the means.

What this ignores is what Adam Smith had to say about liberty and what he called the laws of justice. He made it clear (as I point out in my book, p. 16) that deliberately shifting "a greater share" of resources to an industry than would naturally go to it would retard "the progress of society toward real wealth and greatness."

This is what's happening in America today.

CONCLUSION ...

After World War II the state was instrumental in making sure that almost everyone who worked hard could find the opportunities to get ahead. Then, suddenly, the state came under political attack more than 40 years ago and began to reverse this course. Specifically, it began to promote the interests of Wall Street and industry over the interests of Main Street and working class America.

Not surprisingly, markets are no longer working for middle-class America because the state has been taking sides, to an extreme. This is one of the reasons why the moral justification of capitalism in America has been collapsing over the past 40 years. It's one of the reasons why wages for Main Street have not kept pace with our nation's growing levels of productivity.

Think about it. As I noted at the beginning of this piece, if middle-class wage earners salaries had kept pace with productivity hikes the way they did immediately after WWII someone making $637 per week today would be making an additional $500 a week more. America's national income has grown by more than $12 trillion as productivity and profits have surged, yet wages as a share of national income has actually dropped.

The impact has been significant.

According to data from the Federal Reserve of St. Louis America's middle-class has lost about $1.215 trillion in wages over the last 40 years (which, not so coincidentally, is slightly above what Americans borrowed and owed to the credit card industry when the market collapsed in 2008).

At the end of the day, Adam Smith believed individuals should be free to trade, but only as long as everyone would abide by the same laws of justice. This means no favorable legislation, no regular bailouts, and definitely no artificially cheap money for one group.

The moral justification of capitalism is under attack in America. And it's not coming from the "socialists" or the communists. It's coming from a small group of people who believe the state has nothing to do with their wealth, and the political sycophants in the media and in the halls of Congress who think they are right.

The gap that exists between the theoretical promises of capitalism and the practical realities of our markets is wide, and getting wider. And it's because the moral justification of capitalism in America is on the ropes.

- Mark

Subscribe to:

Posts (Atom)