Looks like a cabin, but it's actually an RV (ViralNova).

Little girl from Norway plays with 14 German shepherds (Episproduction).

Sure, but what methods did they use? According to Italian researchers women who regularly drink wine have better sex lives (Marbella+)

This has to be one of the lamest "10 Ways You Know ..." lists, ever (Womanitely).

THEY'RE NO LONGER PROTECTING OUR RIGHTS ... THE CREEPY SECURITY STATE

In Your Computer: Luke Harding, the author of "The Snowden Files: The Inside Story of the World's Most Wanted Man", talks about being trailed and how his work mysteriously began to self-delete while he wrote about the NSA (The Guardian).

In Your Bedroom: According the latest Snowden revelations, Britain's surveillance agency - with the assistance of the NSA - collected webcam images of well over a million people. Included are a large number of sexually explicit images of people not accused of wrongdoing (The Guardian).

In Your Head: Four Darknesses: The internet is being manipulated and deceived by Western intel internet trolls (Truthdig).

DRUGS, MAN

After "El Chapo" Guzman's capture this is the man next in line to be Mexico's drug kingpin (Newsweek).

Julio Scherer's 2010 interview with "Chapo" Guzman's #2 guy, Ismael "El Mayo" Zambada Garcia (Proceso / it's in Spanish).

Counting the costs of the war on drugs (Count the Costs).

32 reasons why we need to end the war on drugs (Business Insider).

COLLEGE STUFF

What a college education costs around the world (Business Insider).

The college you should attend is ... (BuzzFeed).

University of Mississippi (Ole Miss) fraternity suspended for hanging a noose on the statue of civil rights hero James Meredith (Newsone).

Some things never change ... the far-right in Dallas in November 1963 (Daily Kos).

Former Reagan speech writer Peggy Noonan writes the most ironic and un-self-aware column in the history of Western civilization (Philly.com).

High school biology teacher caught using creationist propaganda to teach science class (ATTP).

Bordering on insurrection: The dangerous rhetoric of the right (Daily Kos).

Six signs of psychosis from GOP fringe this week (Alternet).

THE YING-YANG OF WEALTH

Five lame excuses offered by the super rich to justify wealth inequality (Alternet).

Meet the five gazillionaires who want to close the wealth gap (Syracuse).

MEANWHILE, IN CRAZY LAND ...

Virginia Republican says a pregnant women is just a "host," though "some refer to them as Mothers" (Huffington Post).

Pat Buchanan says conservative Christians are true victims in Arizona (PoliticsUSA).

GOP Congressman: America must support Israel to keep being blessed by God (BuzzFeed).

Texas Tea Party candidate says farmers should be able to shoot "wetbacks" on site, then defends the use of the term wetback claiming that in South Texas it's "as normal as breathing air" (Huffington Post).

Pat Buchanan (again) says "whites are the only group you can discriminate against legally in America now" (PoliticsUSA).

MISCELLANEOUS

One man dancing. He's actually pretty good (Episproduction) ... but not as good as this guy when he practiced in his home studio (Wimp).

The tragedy of Venezuela (The Atlantic).

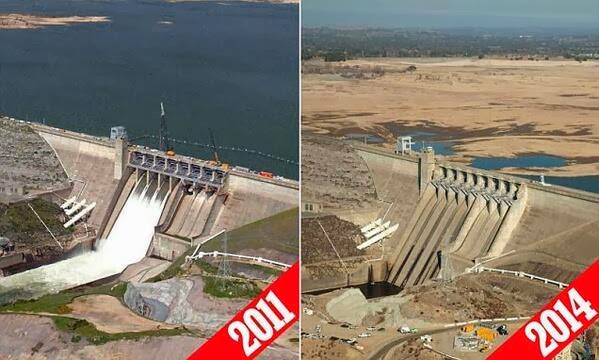

American Aqueduct: The great California Water Saga (The Atlantic).

How Morgan Stanley has raked in billions by manipulating the prices of everyday commodities (Alternet).

- Mark