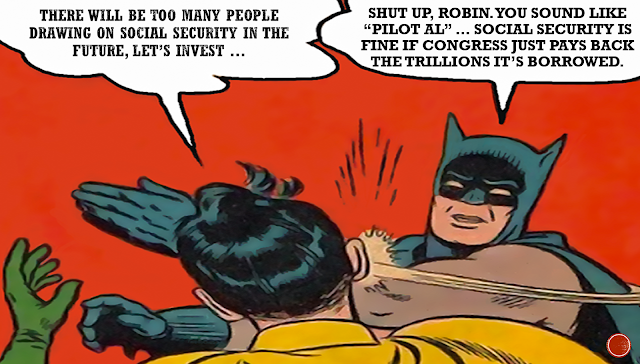

Last week, on January 27th, a FB friend posted this Social Security meme ...

Simple enough, right? The meme makes two very simple points.

First, Social Security is an "INSURANCE PROGRAM." It was created this way because people don't always save for a rainy day and, when they do, there's really no guarantee that the money will be there, especially if Wall Street is involved.

So, yeah, Social Security is an insurance program. It was designed that way. Period. End of story.

The second point is pretty simple too.

Because so many workers have been paying into Social Security the program has been running surpluses, for years. Like trillions of dollars. These surpluses have been sucked out by successive presidential administrations as they've needed money to plug budget holes. This money (about $2.8 trillion) MUST BE paid back.

It says so in the U.S. Constitution. Specifically, the 14th Amendment makes it clear that when we borrow money that debt obligation "shall not be questioned."

Again, pretty simple, right?

Not so fast.

While responding to the FB meme above I wrote, "if we can find $4.3 trillion to bailout Wall Street - who wrecked the economy - we should be able to find the $2.8 trillion that we've raided from our seniors' SS fund."

Here, check it out ...

What I wrote was pretty basic, and self-explanatory. Or so I thought.

I got a response from a former military guy who made a career as a stock broker (wealth manager?). For the sake of simplicity, let's call this FB respondent "Pilot Al."

I've gotten into it before with Pilot Al. Mostly I explain to him that his industry (finance) has been bailed out so often, and been the beneficiary of so much favorable legislation and generous fiscal policies, that it's effectively a ward of the state. Ergo, Pilot Al shouldn't crow about being a rugged individualist who made it on his own, as he would like everyone in the FB world to believe.

As you can imagine, Pilot Al doesn't like me telling him he's not a self-made man, or that he's really a ward of the state. So he's usually looking for a way to go after me in front of his FB friends. It's hilarious, and a lot of fun (for me).

Anyways, Pilot Al responds to my post, and says that my numbers "are bullshit as usual." He likes to cuss. It fills in for the facts he doesn't have, and probably makes him feel like a tough guy.

Pilot Al then went on to explain that he doesn't "disagree with the way the Social Security Trust Fund is invested," and then blames projected Social Security shortfalls on "trending demographics."

Where do I begin?

Let's begin with this. Pilot Al ignored the trillions of dollars borrowed by successive administrations MUST be paid back to the Social Security program.

Oh, Pilot Al also ignored that Social Security is an insurance program, again.

With so much confusion on Pilot Al's part, I took my time reminding him (and everyone in the FB thread) what Social Security is all about. I also explained to Pilot Al how the trillion dollar bailouts and favorable legislation for Wall Street have probably clouded his judgment.

Specifically, I wrote ...

Rather than accept these basic facts, and go away, Pilot Al decided to respond.

Incredibly, rather than address (or acknowledge) how Social Security is an insurance program - and not an investment program - that needs to be paid back Pilot Al seriously drifted off course. He mistook the metaphor I used, misstated why Social Security might fall short of funds (blaming fewer payees rather than focusing on raided Social Security funds) and, strangely, discussed the national debt.

Oh, Pilot Al also childishly pretended he wasn't talking to me because he doesn't "argue with idiots." Yeah, Pilot Al effectively said "neener, neener" and stuck his tongue out at me when he thought no one was looking (as it were). Check it out ...

Of course I had to respond to the silliness. I made sure to reiterate the point that Social Security - per the U.S. Constitution - must be paid back. Because Pilot Al was so petulant, and wasn't talking to me, I also decided to end with a creative flourish.

Pilot Al stopped responding. It's a good thing too. None of the Peanut Gallery that usually chimes in to support him were helping him out. They understood that Pilot Al really didn't know what he was talking about. Many of them also depend on Social Security. They don't want Wall Street (or the government) messing with what they have coming to them.

Moral of the story: If you want to slap down an arrogant Wall Street sycophant, know the issues, be persistent, and be creative when they get in your face. Rinse and repeat as needed.

- Mark

Simple enough, right? The meme makes two very simple points.

First, Social Security is an "INSURANCE PROGRAM." It was created this way because people don't always save for a rainy day and, when they do, there's really no guarantee that the money will be there, especially if Wall Street is involved.

So, yeah, Social Security is an insurance program. It was designed that way. Period. End of story.

The second point is pretty simple too.

Because so many workers have been paying into Social Security the program has been running surpluses, for years. Like trillions of dollars. These surpluses have been sucked out by successive presidential administrations as they've needed money to plug budget holes. This money (about $2.8 trillion) MUST BE paid back.

It says so in the U.S. Constitution. Specifically, the 14th Amendment makes it clear that when we borrow money that debt obligation "shall not be questioned."

Again, pretty simple, right?

Not so fast.

While responding to the FB meme above I wrote, "if we can find $4.3 trillion to bailout Wall Street - who wrecked the economy - we should be able to find the $2.8 trillion that we've raided from our seniors' SS fund."

Here, check it out ...

What I wrote was pretty basic, and self-explanatory. Or so I thought.

I got a response from a former military guy who made a career as a stock broker (wealth manager?). For the sake of simplicity, let's call this FB respondent "Pilot Al."

I've gotten into it before with Pilot Al. Mostly I explain to him that his industry (finance) has been bailed out so often, and been the beneficiary of so much favorable legislation and generous fiscal policies, that it's effectively a ward of the state. Ergo, Pilot Al shouldn't crow about being a rugged individualist who made it on his own, as he would like everyone in the FB world to believe.

As you can imagine, Pilot Al doesn't like me telling him he's not a self-made man, or that he's really a ward of the state. So he's usually looking for a way to go after me in front of his FB friends. It's hilarious, and a lot of fun (for me).

Anyways, Pilot Al responds to my post, and says that my numbers "are bullshit as usual." He likes to cuss. It fills in for the facts he doesn't have, and probably makes him feel like a tough guy.

Pilot Al then went on to explain that he doesn't "disagree with the way the Social Security Trust Fund is invested," and then blames projected Social Security shortfalls on "trending demographics."

Where do I begin?

Let's begin with this. Pilot Al ignored the trillions of dollars borrowed by successive administrations MUST be paid back to the Social Security program.

Oh, Pilot Al also ignored that Social Security is an insurance program, again.

With so much confusion on Pilot Al's part, I took my time reminding him (and everyone in the FB thread) what Social Security is all about. I also explained to Pilot Al how the trillion dollar bailouts and favorable legislation for Wall Street have probably clouded his judgment.

Specifically, I wrote ...

Pilot Al, what's BS is your knowledge of how markets actually work and your flawed understanding of how the SS system was set up in the first place. Let me repeat for you something you apparently never learned, or are incapable of understanding: SS was not set up as an investment instrument, and was never designed to be used as an investment arm of the state (or by the retirees). It's an insurance program. Pretty simple ...

Let me make it even simpler for you Pilot Al, since this is a bit difficult for you. Stay with me here ... If you have insurance on your home and it burns down, would you expect your insurance company to pay up? Of course you would. Now, what happens if they don't because your agent/broker decided to use the money elsewhere, like paying their girlfriends bills or while gambling in Vegas? Wouldn't you demand they make it right, or would you simply call for them to be more diligent on where they spend your premiums in the future (as you're effectively suggesting SS do now)?

Pilot Al, you need to understand that your knowledge of the world has been skewed by the fact that Fed and taxpayer backed bailouts saved your bacon numerous times. This, unfortunately, leads you to believe that your success, and the "success" of the financial sector in general, is a product of sound business strategies. It's not. Sticking your hand out for trillions in bailouts is not success, Pilot Al.

Show of hands: How many think trillions in bailouts for Wall Street after 2008 is a sign of success?

One more thing, Pilot Al. I never said that SS is solvent into the future under the current environment (though it still runs periodic surpluses). It's hard to be whole when others are sticking their hand in the till. What I'm saying - if you bothered to read - is that if we did what we did with the financial sector, and suddenly found the trillions to plug the holes, things become much better. In fact, the SS trust fund becomes solvent way past what the actuaries can forecast (read that again if you need to).

Pilot Al, you need to understand that state-led market bailouts, favorable legislation, and generous subsidies and tax cuts are what made you a "success." Once you understand this you can get off of your market pedestal and acknowledge that you are effectively a ward of the state. Once you see this, it becomes a lot easier to understand that your SS argument - and your "only the market can save the SS system" BS - doesn't hold water.

Rather than accept these basic facts, and go away, Pilot Al decided to respond.

Incredibly, rather than address (or acknowledge) how Social Security is an insurance program - and not an investment program - that needs to be paid back Pilot Al seriously drifted off course. He mistook the metaphor I used, misstated why Social Security might fall short of funds (blaming fewer payees rather than focusing on raided Social Security funds) and, strangely, discussed the national debt.

... Mark will be shocked to learn that insurance companies are required by law to maintain reserve funds to make sure they can pay claims. Those reserve funds are invested. The issue with SS is this. For decades the system took in more money than it paid out. The excess cash had to go somewhere, they were not going to stack cash in some warehouse until they needed it. What they did was "store it" in a special issue Treasury bond. Sometime around 2008-2010, the cash-flow reversed and now they system is paying out more than it collects each year. The government saw this as a cheap source of financing when market interest rates were much higher. As far as raiding the SSI system, I would remind you that when obama came into office the national debt was about $10T and now it is $20T, so you might want to ask him where your money is. Do I think the government will default on SSI payments, NO. Congress will make the payments out of the general fund if the trust fund runs dry. Watch what happens with the SS Disability Trust Fund. I think it is supposed to run out of money in about 4 years. As for why more doesn't get done to fix the mess, American voters tend to shoot the messenger. Politicians demagogue the issue so they kick the can down the road. Currently the SSI Trust Fund can pay full benefits until around 2047. None of the current politicians will be in office when it blows up. California has a similar problem with it's big pension funds. As for Mark's diatribe, I don't argue with idiots.

Of course I had to respond to the silliness. I made sure to reiterate the point that Social Security - per the U.S. Constitution - must be paid back. Because Pilot Al was so petulant, and wasn't talking to me, I also decided to end with a creative flourish.

My God, Pilot Al, you're even more childish than you look. You can pretend you're talking to "Jerry," as if I'm not here, but we all know what's up.

Look, Pilot Al, the insurance example was deliberate, and used more as a metaphor. I'm pretty sure everyone else got it, but since it went right past you let me spell it out for you ... the SS fund-account was raided. While there is no law that says reserve funds must be paid back the U.S. Constitution says the U.S. government must honor its debts, which would include what's owed to the SS account.

What's funny, Pilot AL, is that you actually try and pass yourself off as an expert on all things financial. I guess all those tax-payer backed subsidies and bailouts for your industry did more than pad your bank account. They also stuffed your pie hole full of pious arrogance that's neither warranted, nor substantiated by what you claim to know.

I'd explain the national debt issue - which I've explained elsewhere - but I'm pretty sure you're not up for it (since you're apparently not speaking to me I'll let "Jerry" in on the national debt issue later, and maybe he'll pass a note to you in 4th period class ... this is seriously pathetic 👽).

Sigh ...

Pilot Al stopped responding. It's a good thing too. None of the Peanut Gallery that usually chimes in to support him were helping him out. They understood that Pilot Al really didn't know what he was talking about. Many of them also depend on Social Security. They don't want Wall Street (or the government) messing with what they have coming to them.

___________________________

___________________________

Moral of the story: If you want to slap down an arrogant Wall Street sycophant, know the issues, be persistent, and be creative when they get in your face. Rinse and repeat as needed.

No comments:

Post a Comment