Tuesday, August 27, 2013

Thursday, August 22, 2013

POPE FRANCIS AND THE LAWS OF JUSTICE

Pope Francis is bringing a good deal of attention to economic inequality, injustice, human dignity, and the poor. His approach is distinct from his predecessors, and has caught many by surprise. Bishop Robert McElroy has put together a nice article that outlines several topics that Pope Francis has consistently discussed, which include the poor and issues tied to economic inequality.

Below are three of the key issues that Pope Francis is bringing attention to around the world:

GREAT INEQUALITY GAPS & ARBITRARY TAKINGS

The tyrants of the market have replaced the tyrants of the state. Here's what Pope Francis says ...

"While the income of a minority is increasing exponentially, that of the majority is crumbling. This imbalance results from ideologies which uphold the absolute autonomy of markets and financial speculation, and thus deny the right of control to States, which are charged with providing for the common good. A new, invisible and at times virtual, tyranny is established, one which unilaterally and irremediably imposes its own laws and rules." --Address to new Vatican ambassadors, May 16

OPPORTUNITY

The state creates the conditions under which opportunity and great wealth are created. This should not be undermined. But it is under our current market system. Here's what Pope Francis says ...

"Every economic and political theory or action must set about providing each inhabitant of the planet with the minimum wherewithal to live in dignity and freedom, with the possibility of supporting a family, educating children, praising God and developing one's own human potential. This is the main thing; in the absence of such a vision, all economic activity is meaningless." -- Letter to Prime Minister David Cameron for the G8 Meeting, June 17-18

LAWS OF JUSTICE VIOLATED

Shifting state resources to sectors that don't deserve them, while ignoring the needs of larger segments of society. Here's what Pope Francis says ...

"This happens today: if the investments in the banks fall slightly... a tragedy... what can be done? But if people die of hunger, if they have nothing eat, if they have poor health, it does not matter! This is our crisis today!" -- Address at Vigil of Pentecost, May 18

There's more, which you can read here.

One thing is clear, though. The Pope understands the role of the state in creating opportunities. But he also understands that the resources of the state have been hijacked by market players who now threaten "market collapse" whenever they want to extort favorable legislation, or secure taxpayer funded bailouts from the state. All of this caught my attention because these are the issues that I feature prominently in my book, The Myth of the Free Market.

In a few words, the prerogative(s) and authority of the state have been hijacked by market players. They are using the state to reach their market goals. History's military and political tyrants have been replaced by today's market tyrants. And, it would appear, Pope Francis sees that it's happening.

What this means for his followers, and in the economic swamplands that we call our market place, remains to be seen. Stay tuned.

- Mark

Wednesday, August 21, 2013

SOUTH CAROLINA'S "HOMELESS ZOO"

The area will be patrolled by police.

The new homeless residents - an oxymoron if there ever was one - of the zoned space will be confined to the city emcampment area ... you know, kind of like animals in a zoo.

You can read the details here.

Tuesday, August 20, 2013

ARE WE SLOWLY COMMITTING GLOBAL SUICIDE?

A few years ago I posted on an underwater garbage flotilla that's lurking right below the surface of the Pacific Ocean. It now covers an area twice the size of the continental United States and is, effectively, the world's largest garbage dump.

At the time I thought that this was about as bad as it could get. That was until Japan's Fukushima Daiichi nuclear disaster occurred in 2011. Two years later one Japanese government official is now saying that about 300 tons of contaminated water is leaking into the Pacific Ocean every day (which the Japanese government won't officially acknowledge).

Cleaning up the nuclear mess is expected to take 40 years, and will cost about $11 billion. No word on how long it will take to clean up the floating garbage dump.

In the mean time, over the last two years large numbers of fish in the Pacific Ocean are turning up dead with bleeding from their eyes, bellies, fins, and tails. There's no confirmed link between the fish and the two environmental disasters. But most of us don't need a road map here to tell us we're on the wrong road, and moving into uncharted ecological territory.

For my purposes, I'm tempted to talk about all the economists who tell us that we shouldn't worry about externalities (costs absorbed by unwilling third parties) because every good produced has the costs associated with its production built into the price. Only the buyer and seller need to be concerned about the creation, purchase, and exchange of a product. But having this discussion (at this time) would be tedious, and even distracting.

The real point is that if we look at what's happening to bee colonies and other environmental disasters, like the one caused by BP in the Gulf of Mexico, the larger issue is more dramatic. Simply put, are we slowly committing global suicide?

- Mark

Hat tip to Tom for the Fukushima piece.

At the time I thought that this was about as bad as it could get. That was until Japan's Fukushima Daiichi nuclear disaster occurred in 2011. Two years later one Japanese government official is now saying that about 300 tons of contaminated water is leaking into the Pacific Ocean every day (which the Japanese government won't officially acknowledge).

Cleaning up the nuclear mess is expected to take 40 years, and will cost about $11 billion. No word on how long it will take to clean up the floating garbage dump.

In the mean time, over the last two years large numbers of fish in the Pacific Ocean are turning up dead with bleeding from their eyes, bellies, fins, and tails. There's no confirmed link between the fish and the two environmental disasters. But most of us don't need a road map here to tell us we're on the wrong road, and moving into uncharted ecological territory.

For my purposes, I'm tempted to talk about all the economists who tell us that we shouldn't worry about externalities (costs absorbed by unwilling third parties) because every good produced has the costs associated with its production built into the price. Only the buyer and seller need to be concerned about the creation, purchase, and exchange of a product. But having this discussion (at this time) would be tedious, and even distracting.

The real point is that if we look at what's happening to bee colonies and other environmental disasters, like the one caused by BP in the Gulf of Mexico, the larger issue is more dramatic. Simply put, are we slowly committing global suicide?

- Mark

Hat tip to Tom for the Fukushima piece.

Monday, August 19, 2013

READING FOR THE WEEK (Aug. 19, 2013)

Five more frightening details about the National Security Agency (Truth Out).

Tar sands are leaking in Alberta, Canada and officials don't know where it's coming from, how to stop it, or how to clean it up (Truth Out).

Wall Street is furious that a city is using eminent domain to help people living in homes where they owe more than they're worth (Common Dreams).

AMUSING STUFF

Swedish men told to keep shorts on while swimming because of testicle eating fish (The Telegraph).

This is funny. Mature audiences only (Face Book).

Don't like what Monsanto and GMOs are doing to our diet? Need more information? Watch a 14 year old girl bulldoze right through a Canadian right wing talk show host on the issue (Indiancountry).

BY THE NUMBERS / DEMOGRAPHICS

Cool interactive graph ... U.S. population distribution, 1900 through 2060 (Calculated Risk).

Forty maps that explain the world (Washingtop Post).

Nine facts about child brides around the world (Washington Post).

The world's ten largest and most powerful destroyers & aircraft carriers (The Telegraph).

STUFF CONSERVATIVES REALLY NEED TO READ ... but won't

Another Fox News Success Story: Over half of Americans mistakenly believe annual deficit is rising (Occupy Democrats).

Of Benghazi and BJs - Why Republicans have to demagogue Democratic presidents (Political Garbage Chute).

Why a single-payer system would work (Public Citizen).

History shows that higher minimum wage does not lead to higher unemployment (Occupy Democrats).

Social security is a model, not a failure, for Washington budget making (Christian Science Monitor).

- Mark

Sunday, August 18, 2013

BILLBOARD PRODUCES WATER OUT OF AIR IN PERU

Via Beauty Exists we get this pretty cool demonstration of science at work for humanity. Peru's University of Engineering and Technology (Universidad de Igeneria & Tecnologia) created a billboard that produces water out of thin air ...

- Mark

Kudos to Tom for sharing this on FB.

- Mark

Kudos to Tom for sharing this on FB.

ADAM SAVAGE: FROM INQUIRY TO IDEAS, AND SCIENTIFIC DISCOVERY

This is a pretty cool explanation of what's behind the scientific method. The process, in turn, has allowed us to make the discoveries that bring us closer to the truth and a better understanding of our world ...

- Mark

Friday, August 16, 2013

DERIVATIVES EXPLAINED, PART II ... The Financial Commodity Tidal Wave

Derivative contracts can be tied to commodities like corn, lumber, and cotton and, conceptually speaking, have existed as long as markets have existed.

The question for us today is how in the world did derivative markets, which were once primarily associated with agriculture commodities like corn, wheat, and cotton, come to be dominated by today's financial commodities that are built around debt?

Put another way, how did America's economy, which functioned well when derivative contracts focused on agriculture goods, become enslaved to debt-drenched financial instruments that collapsed our economy in 2008?

This is a big question. The answer lies in understanding the role of deregulation and its relation to something we call our shadow banking system.

THE BIRTH OF OUR SHADOW BANKING SYSTEM (the Backbone of Financial Derivatives)

Beginning in the 1980s the United States went on a deregulation binge. This was great for people who had money because it would eventually encourage market players to operate outside of the regulatory framework created for banks and our financial system after World War II.

By the beginning of the 21st century most market players with money would operate in the shadows of of our regulated financial system. Hence the "shadow banking" system. These market players would become the new Banker Gods in America.

The reason for the deregulation binge was quite simple.

Competition from abroad, the turmoil of the 1960s, plus the debt and OPEC-induced inflation in the 1970s created a period of economic uncertainty. Unfortunately, rather than look at the reasons for the competition (the success of the Bretton Woods system) or trying to understand the events of the 1960s and 1970s (Vietnam, debt, and short sighted policies) an emphasis was placed on going after regulations, lowering taxes, and even more deficit spending.

For our purposes here I will focus on the push for deregulation, which was relentless in the 1980s and 1990s.

In the financial sector deregulation would enable wealthy market players to lend money to middle-class America (through loan "brokers"). Borrowers liked the new environment because they didn't have to deal with stingy bankers, who had the audacity to check and see if borrowers could actually pay their bills. Bankers had to follow the rules because it was the law. Perhaps most important, if you didn't pay your bills the bank who originated the loan was on the hook for the losses.

In the new deregulated environment all of this changed.

* New unregulated market players entered the scene as lenders.

* Banks and new market players could now sell the loans they originated. Others would have to deal with the payments, and the consequences.

* Loans that were sold could be bundled up by the thousands, and then sold to other market players as cash producing securities.

Best of all for the borrowers they just had to satisfy "lending brokers," who were more than happy to turn a blind eye to the red flags in a borrowers financial history. As long as they got a commission the brokers were more than happy to make the loan. And why not? The loan was going to be sold off and bundled up anyways. The broker could care less if the loan was ever repaid.

Cue the financial derivative explosion.

UNDERSTANDING FINANCIAL DERIVATIVES

It's at this point that the agriculture derivatives market takes a back seat to the financial derivatives market. Because many find this market confusing, I'm going to over generalize below.

Because deregulation had made lending and borrowing money so easy, selling and bundling up loan (debt) contracts became the name of the game. Derivative contracts based on debt - which could be car loans, credit card debt, home mortgages, etc. - became the new hot "commodity" in financial markets.

Derivative contracts based on agriculture commodities would take a back seat to the new financial toy on Wall Street.

There are many and very specific categories for each family of bundled up loans that become derivative products. I won't go over those here (but I do so in my book). The important thing to keep in mind is that the majority of these bundled contracts are generally called collateralized debt obligations (CDOs). A clumsy way to understand the term is to see CDOs as debts that others are obligated to pay, with the payments serving as the collateral for market players who purchase the CDOs.

I know, I know ... "CDO" is a clumsy way of saying "debt payments are my source of income" but this is how Wall Street wants it. If you think "bundled up debt," CDO, and "derivative markets" sound complex and mysterious you will be less inclined to challenge the logic behind putting more and more people in debt with credit cards, new home loans, and refinance specials. The name of the game is to get more people to borrow money.

In any case, and in plain speak, deregulation laid the groundwork for debt to become a commodity on Wall Street.

Because debt drenched derivatives were new, and so complex, market players in America gobbled them up like hot cakes. No one likes to look stupid on a hot commodity, even if it's all based on heavily indebted consumers keeping their jobs after refinancing or purchasing items they really couldn't afford. Besides, payment rules built around bankruptcy reform in 2005 and student loan regulations, among others, helped create the facade that debt would become Wall Street's cash cow (another topic for another day).

The shadow bankers and other market players had a field day in this environment.

They created and sold loans to feed the new commodity boom that, again - when we cut through the market speak - really rested on creating more debt in America. What started off as a trickle in the 1980s and 1990s would explode with even more deregulation during the aughts (or when President Bush was in office).

Today, with the U.S. economy is slated to produce about $16 trillion in goods and services, the countries biggest traders in derivatives - JP Morgan Chase, Bank of America, and Citi Group - have made derivative trade bets on about $175 trillion in assets (not just debt laden derivatives).

Today, about 90% of all derivative trading in the U.S. is done by the four largest banks, while the notional value (asset base) of all the derivative trading done around the world hovers around $700 trillion (with one group placing the value at $1.14 quadrillion).

At the same time that trading in derivative products shot through the roof market players busied themselves finding insurance for their new commodity products. They needed the insurance because they wanted desperately to believe that if their bundled up financial instruments failed they would still get their money. I will discuss these insurance instruments in my next post on derivatives.

Still, one thing is clear after the 1980s. Deregulated shadow bankers had a field day. As the author of The Trillion Dollar Meltdown noted, by 2006 only about a 25% of all lending in America was done by traditional, and strictly regulated, banking institutions - down from about 80% just twenty years earlier.

Free marketeers rejoiced at this development because, as Alan Greenspan gushed at the time, with unregulated financial players providing new cash "a new paradigm of active credit management" had been created in America. Happy Days were here again.

Then 2008 happened.

I will discuss this, and more, in my next post on this topic, Derivatives Explained, Part III ... Why Financial Derivatives Are Still Dangerous.

- Mark

TEN THINGS TO KNOW ABOUT MONEY & POLITICS

From Open Secrets we get "The Top 10 Things Every Voter Should Know About Money and Politics" ...

1. Money Follows Power (one for the millenium)

2. Incumbents Almost Always Win (or, the Soviet Union Poliburo had nothing on us)

3. Most Races in Congress Are Not Competitive (thank you gerrymandering)

4. Small Donors Make Good Press, Big Donors Get You Reelected (show me the money)

5. The Interests Behind the Money Are Predictable (and well rewarded)

6. Donors Seek Long-Term Relationships (they're buying a seat at the table, not a knock on the door)

7. The Fundraising Never Stops (its QVC for politicos)

8. Enforcement of Campaign Laws is Weak (if they can write the laws what do we expect?)

9. All Hell Broke Loose After 2010 (thank you Citizens United)

10. They Don't Have to be Crooks, Just Human (the system is rigged)

You can read the details from the top 10 list here.

- Mark

Kudos to Tom for sharing this on FB.

UPDATE: In a related story ... http://www.truth-out.org/progressivepicks/item/18174-money-and-the-corporate-media-are-gagging-democracy

Wednesday, August 14, 2013

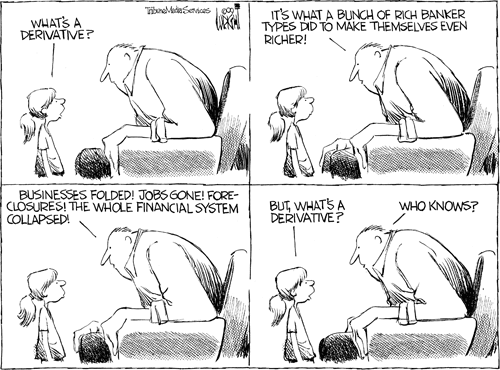

DERIVATIVES EXPLAINED, PART I ... EARLY HISTORY

Derivatives helped blow up our financial markets and wreck our economy in 2008. Yet most Americans - and most members of the U.S. Congress - still have no idea what derivatives are, nor how they wrecked our economy.

If you're one of these people, don't worry. We'll fix that here.

While pundits and market players seem to enjoy making the topic more difficult than it is, in real simple terms a derivative product derives its value from an asset or product that has not yet been created.

So, for example, over 100 years ago, if a wheat farmer wanted to avoid sticker shock at the market they might offer to sell their entire crop to a buyer six months in advance. This made sense because a wheat farmer not only knew what they would receive for their wheat the day they arrived at the market but the purchaser of the wheat knew how much they would spend on a product months in advance.

The resulting wheat contract derives its value from what's going to be produced and delivered to market in six months. Hence the name derivative contract.

Depending on the weather, droughts, gluts, disease, transportation problems, etc. either the seller or buyer of the wheat could do very well. In all cases, securing a price for products in advance - or in the future - allowed America's commodity markets to stabilize and become more dependable.

This enabled all involved to plan for the future.

The formal recognition of the importance of these transactions was noted with the creation of the Chicago Board of Trade (CBOT) in 1848, where trading in "forward" or "to-arrive" goods occurred. Derivative contracts with future prices already cooked into the contract became standard practice. Farmers, dealers and other merchants flocked to the CBOT, which officially began publishing "futures" prices in 1877.

If the buyer of wheat decided that they didn't need the wheat, or if the seller of the wheat didn't want to farm, but knew another farmer who did, the contract(s) could be bought or sold to others. This helped facilitate market efficiency. Over time, banks and other traders recognized that those holding "futures" contracts held something of value and began extending loans based on the derivative contracts.

As you can imagine, if the wheat farmer doesn't show up things can get ugly. This is especially the case if the dealer who purchased the contract has already promised (sold) the wheat to another market player.

How derivative contracts, that were once the domain of agriculture commodity markets, came to be dominated by the financial commodity markets that collapsed the American economy in 2008 (as Warren Buffet suggested they would) will be discussed in my next post.

- Mark

FYI: To help avoid confusion, because derivative contracts derive their value from something that is supposed to happen in the future keep in mind that they are often referred to as both futures and derivative contracts.

Part II on this topic: Derivatives Explained ... The Financial Commodity Tidal Wave.

Part III on this topic: Derivatives Explained ... Why Financial Derivatives Are Still Dangerous.

Tuesday, August 13, 2013

YES, PRESIDENT OBAMA IS MAKING A DENT

In the FYI category, President Obama has had several policy victories to brag about (in spite of Republican obstructionism). Here they are:

TAXES ON THE SUPER RICH HAVE INCREASED: Through Obamacare tax hikes and hundreds of billions more in the fiscal cliff deal, the super rich (top 1%) have seen their share of taxes increase on average from 28% to 36% (though the rate is still smaller than it was between 1940 and the late 1970s).

NO TAX HOLIDAY FOR THE MULTINATIONALS: In spite of asking and pushing President Obama on the issue, multinational corporations in the U.S. have yet to receive the tax holiday they want to bring foreign earnings back to the United States.

SPENDING ON HEALTH FOR CHILDREN AND THE POOR TO INCREASE: Spending on Medicaid and Children's Health Insurance Program (CHIP) is scheduled to increase by $710 billion over the next ten years.

And make no mistake about it, the spending increases on the poor for both Medicaid and the CHIP program are paid for with new taxes and savings in spending that President Obama has orchestrated. All of this helps to explain why we will see our budget deficit in 2013 fall below $1 trillion for the first time since President Obama inherited President Bush's trillion dollar run away train deficits.

So, yeah, President Obama is making a dent.

- Mark

Sunday, August 11, 2013

SEE THE PROBLEM?

Millionaires, which include people like Donald Trump, have used bankruptcy.

Cities can file for bankruptcy protection, and then go after unions and city pensions.

Wall Street can wreck the economy and get the U.S. Congress to provide trillions in bail out funds.

But 37 million formers students - many of whom are seeking first time career jobs in an economy Wall Street collapsed - are forced to drown in student loan debt because they can neither discharge their debts in bankruptcy, nor become eligible for bailout cash.

See the problem?

- Mark

Friday, August 9, 2013

READING FOR THE WEEK (8-09-13)

Introducing the now 63 year old woman who inspired one of my favorite songs, "The Girl From Ipanema" (Mail Online).

The 7 craziest Obamacare conspiracy theories (Mother Jones).

For the Truthers out there ... 9/11 firefighters reveal that it was bombs that destroyed WTC lobby (TopInfoPost).

Melting ice forms lake in the North Pole (CBS News).

GENERAL POLITICS AND ECONOMICS

The war on America's social contract. Detroit is the front line (Nation of Change).

Detroit follows the lead of Cyprus and will "bail-in" pensioners in order to save the bets made by the banks (Truth Out).

The three biggest lies used to explain why corporate taxes should be lowered (Nation of Change).

E-mail trail links Bush foundation, education officials and corporations together in effort to advance charter schools, on-line education, and standardized one-size fits all scores that make corporate donors richer (Washington Post).

A multi-currency world is on the horizon, which means we are returning to the more competitive, and contentious, Victorian Age (Financial Times).

The argument for state owned banks (Truth Out).

8 ways privatization has failed America (Nation of Change).

OUR EVOLVING NATIONAL SECURITY STATE

The 217 Representatives who voted to allow the NSA to continue spying on all your data ... and, yes, Bakersfield's own Kevin McCarthy is one of them (Tech Dirt).

Yeah, your liberty and freedom are for sale ... Lawmakers who voted to allow continued NSA spying received, on average, double the campaign cash from the defense industry than those (205) who voted no (Wired).

FBI admits flying drones over the U.S. without warrants (RT).

You can't make this stuff up ... the future home of the Department of Homeland Security, and other national security crazies, was once a mental hospital (Bloomberg News).

Hacker who was going to demonstrate how to remotely kill pacemaker patients dies day before he was going to present in Las Vegas (RT).

Welcome to post-Constitution America ... Big Brother is upon us (Nation of Change).

- Mark

Thursday, August 8, 2013

Wednesday, August 7, 2013

I'M GLAD MY DAUGHTER DOESN'T HAVE TO WORRY ABOUT THIS

From Upworthy we get another interesting story that demonstrates how far we've all come over the past 50 years ...

- Mark

- Mark

Tuesday, August 6, 2013

FINANCIAL ENGINEERS WORKING ON OUR NEXT FINANCIAL TRAINWRECK

It appears that the financial engineers learned nothing from the market stupidity that led to the 2008 market meltdown. They're setting us up for another financial train wreck. Check this out ...

BACKGROUND

One of the biggest problems we saw with the market meltdown was tied to market players (they're not investors) who thought they were masters of the universe because of the "brilliant" debt drenched money making schemes they developed.

At the heart of the money making plans were easy money and flimsy investment instruments - derivative products - that only paid out if millions of debt laden consumers kept their jobs and made regular payments on their debts. To convince themselves that they had a sure thing market players got the ratings agencies to give their products AAA ratings, then went out and purchased insurance (Credit Default Swaps) from unregulated groups that, as it turns out, didn't have the money to pay out claims when the s**t hit the fan.

With flimsy investment instruments backed by a faux insurance regime market players proceeded to borrow lots of money, which they could do in an era of deregulation, to make trillions of dollars in market bets.

And why not? Then Federal Reserve Chair Alan Greenspan had blessed the debt fueled financial engineering, bragging that the wizards on Wall Street had created a "new paradigm of active credit management."

Then, in 2008, the market collapsed on its own nonsense. Oops.

TURNING STRAW INTO GOLD, AGAIN

The global firms and institutions that got caught up in the 2008 market collapse lost hundreds of millions, with larger institutions losing many billions more. Fortunately for the financial institutions who lost money from around the world the skewed bailout culture (that was led by the United States) also included favorable legislation and generous tax write-offs from their home countries.

Perhaps one of the biggest favors was allowing the foolish market players, who got caught up in the debt and derivatives mess, to deduct their losses from future earnings. This saved many firms from bankruptcy, and many more individuals from financial ruin.

Among the many firms and institutions that got caught up in the debt drenched mess were banks in Spain. They borrowed from international markets and fueled the Spanish real estate bubble, which popped in 2008. But the banks in Spain now have a problem. As part of the larger global effort to clean up the market mess, Spanish banks - per Basel III - are supposed to have more cash reserves on hand. The banks don't have the money.

This is where it gets fun.

Spanish banks want to take the losses that they absorbed after 2008 and convert them into hard cash assets. How do you convert a monetary loss into hard cash, you ask? Simple, you get the government to sign off on turning your future tax deductions into hard cash today. Banks in Spain are currently petitioning the Spanish government to "advance" them future tax deductions with billions in credits.

All of this will be paid for by the Spanish taxpayer, of course.

Specifically, with about $65 billion in losses (a little more than €50 billion Euros), Spanish banks are asking the government to turn about two-thirds of their $65 billion in losses into bank credits. For this to happen the Spanish government will have to credit each private bank account with billions out of government accounts. Call it Financial Engineering Dos Punto Zero.

At issue here is whether the Spanish government - which has serious financial problems of its own - can afford to credit the banks the money they want.

If you're looking for an analogy to what the Spanish banks are asking for think of an average home owner in the U.S. who's paying off their mortgage. Tax law in the U.S. allows homeowners to deduct a large portion of the interest they pay on their mortgage loan. If a homeowner deducts $2,000 per year in interest over the next five years the homeowner will receive $10,000 in deductions. If we use the plan outlined by the Spanish banks, instead of asking for deductions over the next five years the mortgage payer in the U.S. could ask the government to front them $10,000.

And just like that the homeowner gets $10,000 because of a neat accounting trick that turns a tax asset into a bank credit.

But wait, if we cross the Atlantic, the creativity behind the financial engineering only gets better.

DERIVATIVES 2.0

Remember the flimsy investment products I discussed above? You know, the bundled up mortgage contracts with the faux insurance plans that only pay out if the debtors in the financial pyramid actually makes regular payments. As we know, the debt drenched derivative system didn't work out so well.

Still, in spite of crashing the market with derivative laced bets in 2008 the financial engineers on Wall Street now want to bundle up monthly rent payments, and turn them into new and improved derivative products that they want to sell as securities.

In effect, the financial mandarins of the world are saying to the taxpayers, "So what if the derivative contracts we stacked on top of one another and sold as securities took us into the financial crapper in 2008. We'll have more luck with securitized rents this time because we've worked on the debt-laced kinks ... and yeah, we think you're that stupid."

At the end of the day the financial engineers are at it again. They're still trying to turn straw into gold. In reality, bit by bit, they're setting up our next financial train wreck. And no one seems to care.

- Mark

BACKGROUND

One of the biggest problems we saw with the market meltdown was tied to market players (they're not investors) who thought they were masters of the universe because of the "brilliant" debt drenched money making schemes they developed.

At the heart of the money making plans were easy money and flimsy investment instruments - derivative products - that only paid out if millions of debt laden consumers kept their jobs and made regular payments on their debts. To convince themselves that they had a sure thing market players got the ratings agencies to give their products AAA ratings, then went out and purchased insurance (Credit Default Swaps) from unregulated groups that, as it turns out, didn't have the money to pay out claims when the s**t hit the fan.

With flimsy investment instruments backed by a faux insurance regime market players proceeded to borrow lots of money, which they could do in an era of deregulation, to make trillions of dollars in market bets.

And why not? Then Federal Reserve Chair Alan Greenspan had blessed the debt fueled financial engineering, bragging that the wizards on Wall Street had created a "new paradigm of active credit management."

Then, in 2008, the market collapsed on its own nonsense. Oops.

TURNING STRAW INTO GOLD, AGAIN

The global firms and institutions that got caught up in the 2008 market collapse lost hundreds of millions, with larger institutions losing many billions more. Fortunately for the financial institutions who lost money from around the world the skewed bailout culture (that was led by the United States) also included favorable legislation and generous tax write-offs from their home countries.

Perhaps one of the biggest favors was allowing the foolish market players, who got caught up in the debt and derivatives mess, to deduct their losses from future earnings. This saved many firms from bankruptcy, and many more individuals from financial ruin.

Among the many firms and institutions that got caught up in the debt drenched mess were banks in Spain. They borrowed from international markets and fueled the Spanish real estate bubble, which popped in 2008. But the banks in Spain now have a problem. As part of the larger global effort to clean up the market mess, Spanish banks - per Basel III - are supposed to have more cash reserves on hand. The banks don't have the money.

This is where it gets fun.

Spanish banks want to take the losses that they absorbed after 2008 and convert them into hard cash assets. How do you convert a monetary loss into hard cash, you ask? Simple, you get the government to sign off on turning your future tax deductions into hard cash today. Banks in Spain are currently petitioning the Spanish government to "advance" them future tax deductions with billions in credits.

All of this will be paid for by the Spanish taxpayer, of course.

Specifically, with about $65 billion in losses (a little more than €50 billion Euros), Spanish banks are asking the government to turn about two-thirds of their $65 billion in losses into bank credits. For this to happen the Spanish government will have to credit each private bank account with billions out of government accounts. Call it Financial Engineering Dos Punto Zero.

At issue here is whether the Spanish government - which has serious financial problems of its own - can afford to credit the banks the money they want.

If you're looking for an analogy to what the Spanish banks are asking for think of an average home owner in the U.S. who's paying off their mortgage. Tax law in the U.S. allows homeowners to deduct a large portion of the interest they pay on their mortgage loan. If a homeowner deducts $2,000 per year in interest over the next five years the homeowner will receive $10,000 in deductions. If we use the plan outlined by the Spanish banks, instead of asking for deductions over the next five years the mortgage payer in the U.S. could ask the government to front them $10,000.

And just like that the homeowner gets $10,000 because of a neat accounting trick that turns a tax asset into a bank credit.

But wait, if we cross the Atlantic, the creativity behind the financial engineering only gets better.

DERIVATIVES 2.0

Remember the flimsy investment products I discussed above? You know, the bundled up mortgage contracts with the faux insurance plans that only pay out if the debtors in the financial pyramid actually makes regular payments. As we know, the debt drenched derivative system didn't work out so well.

Still, in spite of crashing the market with derivative laced bets in 2008 the financial engineers on Wall Street now want to bundle up monthly rent payments, and turn them into new and improved derivative products that they want to sell as securities.

In effect, the financial mandarins of the world are saying to the taxpayers, "So what if the derivative contracts we stacked on top of one another and sold as securities took us into the financial crapper in 2008. We'll have more luck with securitized rents this time because we've worked on the debt-laced kinks ... and yeah, we think you're that stupid."

At the end of the day the financial engineers are at it again. They're still trying to turn straw into gold. In reality, bit by bit, they're setting up our next financial train wreck. And no one seems to care.

- Mark

40 WAYS OBAMACARE IMPROVES LIVES

So the GOP has now voted to repeal Obamacare 40 times. To mark the occassion the White House just released the 40 ways Obamacare is working to improve lives in America. You'll understand why I italicized #16 below when you click here ...

1. Say goodbye to lifetime limits: Insurance companies will no longer be able to place an arbitrary cap on coverage.

2. Children can no longer be denied health insurance because of a pre-existing condition.

3. Starting in 2014, adults will no longer be denied health insurance because of a pre-existing condition.

Free preventive care, including:

4. Annual check-ups

5. Contraception

6. Vaccinations

7. Gestational diabetes screenings

8. Mammograms

9. Screening and counselling for HIV

10. Cholesterol screenings

11. Colonoscopies

12. Blood pressure screenings

13. Cancer screenings

14. Osteoporosis screenings

15. Young adults can stay on their parents' insurance plans until the age of 26.

16. If insurance companies aren't spending your premium dollars on your health care—at least 80 percent—they've got to give you some money back.

17. Insurance companies can't raise your rates by double-digits without justification.If you couldn't make it through all 40 just imagine what's (not) happening in our GOP-led Congress, where their obstructionism has them preparing to vote against Obamacare for the 41st time.

18. Insurance plans can’t require higher co-payments or co-insurance if you get emergency care from an out-of-network hospital.

19. Women will no longer be charged more than men just because they're women.

20. The health insurance marketplace will be ready to go in every state starting October 1 of this year.

21. No-hassle comparisons: The online marketplace provides easy access to information on all available plans, so you can do a side-by-side comparison and find a plan that works for you.

22. Many Americans will be eligible for financial assistance to help them buy health insurance on their own, so you can afford a plan that will be there if you get sick.

23. When you buy insurance through the marketplace, premiums can be determined based only on these four factors: where you live, how old your are, how large your family is, and whether or not you are a smoker.

24. In the marketplace, you can choose a plan that matches your budget and needs: Platinum, Gold, Silver or Bronze.

25. By 2020, the Medicare prescriptions drug "donut hole" will be closed for good.

These are the essential benefits that all health plans in the marketplace must cover:

26. Ambulatory patient services

27. Emergency services

28. Hospitalization

29. Prenatal care

30. Neonatal care

31. Mental health services

32. Prescription drugs

33. Rehabilitative services and devices

34. Laboratory services like bloodwork

35. Preventive care

36. Wellness services

37. Chronic disease management

38. Pediatric services, including oral and vision care

39. Lower prescription drug costs for people on Medicare.

40. These states are already foreseeing dramatic drops in premiums: New York, California, Nevada, Connecticut, Oregon.

Monday, August 5, 2013

FIVE REASONS WHY FINANCIAL REFORM IS A SHAM

Want to know why financial reform, also known as the Dodd-Frank Act, hasn't done much to slow down the gambling on Wall Street? Money Morning's Garrett Baldwin discusses the reasons here. I've synopsized Baldwin's arguments below. In brief, Dodd-Frank isn't effective because ...

1. Ex Post Facto Power: Dodd-Frank creates rules - like the FDIC's "resolution authority" - that kick in after a crisis happens, while postponing or watering down rules that would prevent a crisis in the first place.

2. Too Big To Fail (still): Together JP Morgan Chase, Citibank, Wells Fargo, and Bank of America have enough assets under their roof that it equals 97% of the GDP of the U.S. in 2012. Dodd-Frank does nothing to alter this.

3. No Glass-Steagall Firewalls: The commercial and investment activities of each of these banks remain under one roof. Because of propietary trading, interconnectedness, and repo activities, a collapse in one area of the bank could drag the rest of the bank(s) with it.

4. Volcker Rule Neutered: While the Volcker Rule was designed to prevent banks from using client accounts and FDIC insured deposits for their financial benefit the Volcker Rule has been so watered down as to render it toothless.

5. Bank Lobbying Dominates: Banks get far more face time with lobbyists than do reform groups. To date Goldman Sachs has had 222 meetings with regulators while JP Morgan has had 207. This is one of the reasons why the Volcker Rule was neutered and only 159 of 389 Dodd-Frank rules have been finalized.To this I would add that even when the financial sector gets caught they're allowed to pay fines rather than have anyone go to trial, let alone get convicted.

In a few words, when it comes to addressing the issues that led to the 2008 market collapse big loopholes remain. So, yeah, white-collar crime still pays.

- Mark

Sunday, August 4, 2013

INTERESTING READS FOR THE WEEK (Aug. 4, 2013)

Drunk Goldman Sachs employee knocked out after screaming racial slurs, black patron arrested for punching the idiot (Zero Hedge).

FBI was aware of plan to use snipers on Occupy Houston movement (Chron).

No more free sun ... Arizona's biggest utility wants to tax solar energy that's sent back into the grid (Tree Hugger).

Scientist discover cause of bee deaths, and it's really bad news (Tree Hugger).

OUR EVOLVING NATIONAL SECURITY STATE

Senator Ron Wyden (D-OR) on NSA spying: It's as bad as Edward Snowden says (Alternet).

NSA XKeyscore surveillance tool collects "nearly everything a user does on the internet" (The Guardian).

The White House is unable to confirm whether they briefed Congress on XKeyscore (The Guardian).

The worldwide surveillance and privacy war, which you already lost (Testosteronepit).

There goes our privacy ... SWAT team raids home because of two separate Google browser searches (Alternet).

Google engineer wins NSA award, then says NSA should be abolished (Alternet).

NSA spying absurdity ... fake PR Skype account created to help NSA, then taken down after outcry, and then put back up with "parody" disclosure (Zero Hedge).

BY THE NUMBERS

Six ways Rabid Republicans are declaring war on America (Alternet).

Eight shocking ways the United States lead the world (Alternet).

The 10 hungriest places in America ... and Bakersfield is #1 (Take Part).

- Mark

THE REPUBLICAN BUBBLE

From Bill Maher. This is what it's like when I try to explain reality - or "irrefutable facts" - to my conservative friends on Facebook. And, yes, you know who you are ...

- Mark

- Mark

Saturday, August 3, 2013

WALL STREET: A BRANCH OFFICE OF THE FEDERAL RESERVE

Since March 2009 the total amount of goods and services produced by the U.S. (or GDP) has increased by $2.3 trillion. However, the total capitalization of the U.S. stock market has grown by $12.3 trillion.

So what's happening? In a few words, the growth in the market is tied to low interest rates and regular money dumps from the Federal Reserve. Artificially cheap money has allowed market players to both game and energize the system in ways most Americans don't understand, which explains our surging stock market in a recession drenched economy.

So what's happening? In a few words, the growth in the market is tied to low interest rates and regular money dumps from the Federal Reserve. Artificially cheap money has allowed market players to both game and energize the system in ways most Americans don't understand, which explains our surging stock market in a recession drenched economy.

Commenting on these developments former Reagan budget director David Stockman makes it clear that our markets aren't real because they are "medicated" with low interest rates from the Federal Reserve. In the process of institutionalizing the Greenspan Put we've also destroyed capital markets.

Worse, Stockman adds, because the stock market is so dependent on the Federal Reserve capital markets in America are now "dead" while Wall Street has effectively become a "branch office - branch casino - of the central bank." The end result is that there is no free market in America because "you can't have capitalism if the capital markets are dead."

- Mark

Worse, Stockman adds, because the stock market is so dependent on the Federal Reserve capital markets in America are now "dead" while Wall Street has effectively become a "branch office - branch casino - of the central bank." The end result is that there is no free market in America because "you can't have capitalism if the capital markets are dead."

- Mark

Friday, August 2, 2013

WHAT'S WRONG WITH DETROIT ... AND AMERICA

Contrary to what you've heard, the fiscal problems of Detroit, and the challenges that confront America, are not so simple, or the result of unions. The 79,500 Michigan jobs/workers that were displaced or shipped to China between 2001 and 2007 didn't happen because of mysterious "magic of the market" forces. Nor did Detroit's tax base suddenly disappear because of incompetent political leadership (though the incompetence didn't help).

Michigan's jobs and manufacturing picture worsened - as did the nation's - because of policies taken by the federal government over the past 30 years. These policies rewarded companies for shifting manufacturing jobs around the world.

When jobs leave so does the tax base. Pretty simple.

Now, someone reading this might be screaming at their screen right now that unions priced the American worker out of the global labor pool by demanding too much. Think again.

Germany produces twice as many cars as the United States. Their unionized auto industry pays workers significantly more than what the U.S. auto industry pays. Indeed, when you take out what it costs for health care (Germany has universal health care) we find that German auto workers make about two times what their U.S. counterparts earn, while benefits for German workers are substantially more rewarding (8 weeks paid vacation, free day care, etc.).

So, the big question is if German auto workers make far more than their U.S. counterparts, why is it that Germany hasn't experienced collapsing industrial cities like Detroit? Why is it that Germany - with its higher salaried auto workers - is seen as the key to Europe's economic stability, while the U.S. is still languishing in a 2008-induced market zombie walk?

SO, WHAT HAPPENED TO DETROIT?

While I could write about the government escorted financialization of America's economy - which is a big problem - for our purposes there are three other developments that help us understand what's happened to Detroit's, and America's, manufacturing base.

The first development is pretty simple. For the longest time no one wanted to buy U.S. automobiles. Beginning in the early 1970s America's auto makers began producing crap. Remember the Gremlin? The Corvair? The Pinto? The Chrysler Imperial LeBaron Two Door? The AMC Pacer? The Chevy Chevette? This wasn't the workers fault. This one is on management. When auto manufacturers in America were forced to shut their doors jobs disappeared too.

The second answer is a bit more complex, but still relatively simple too.

Germany's constitution and social culture embrace unions, worker councils, and the right to strike. This helps shape Germany's union-management relations so that they are collaborative, as opposed to being adversarial (the case in the United States). It's the primary reason that Germany didn't experience wholesale layoffs in the auto industry after the 2008 market collapse (offering "extended vacations" instead). Unions and management worked together to keep people employed.

Finally, apart from producing crummy automobiles and going after unions, the United States has gone out of its way to encourage its auto industry and manufacturing base to leave, while doing little to protect American workers. Think about the following.

As I noted above, between 2001 and 2007 Michigan lost 79,500 auto jobs to China. This happened because of specific government policies, both here and in China.

1. Free Trade Agreements: The U.S. has entered into numerous trade agreements that facilitate moving manufacturing jobs overseas, especially to low paying regions of the world.

2. Currency Manipulation: China has been allowed to manipulate its currency, which enables it sell more goods in the United States.

3. Labor Rights Abused: China regularly suppressed labor rights, which lowers manufacturing wages by as much as 47% to 86%, and attracts manufacturers from the U.S.

Throw in generous U.S. tax credits for business expenses - which include credits for shipping jobs overseas - and it's easy to understand why almost 3 million jobs in the United States were outsourced or were displaced by government policies between 2001 and 2007 (the German government, on the other hand, appears to have had a role in saving VW from a hostile takeover in 2008 by orchestrating the largest hedge fund loss in history).

By sending taxpayer funded trade representatives to negotiate trade deals, while ignoring currency and labor abuses, the U.S. government has effectively told Detroit and America's industrial base - and the middle class - we don't care about you. The end result is that millions of American jobs have been sent to countries all over the world.

Overseas profits and executive pay in the United States has climbed, but workers and America's middle class are left scrambling for what's left.

WHAT AMERICA'S WORKERS ARE COMPETING WITH

The interesting thing about these developments is that while negotiating trade agreements the private sector has been adamant about protecting proprietary rights and corporate patents. Forcing governments around the world to go after street vendors and protect intellectual property rights is part of our larger free trade negotiating position.

Worker rights, however, are an entirely different matter.

Forced or slave labor? No problem, send the products here. Child labor? No problem, send the products here. Unsafe working conditions? No problem, send the products here. All of this has made it easier to go after labor here in the United States.

To be sure, there's no doubt that German auto makers produce cars in China. But they don't do so as part of a larger policy goal of driving down wages in Germany. The idea that we're all in this together is rooted in Germany's historic approach to economics, and is not simply a shop floor poster in Germany.

Forcing the American worker to compete with laborers who have few protections and can't defend themselves undermines the moral justification of capitalism (the idea that you can work hard and get ahead). It also defeats the spirit of democracy that we fought two wars in the 20th century to promote.

At the end of the day, as I wrote three months ago, if we wanted to demand global labor rights we could. But we don't. This encourages firms in the United States to go abroad, which helps explain what's happened to Detroit and in America.

- Mark

UPDATE (Aug. 2, 2013): And let's not forget that some of the largest economic subsidies and tax breaks - which erodes a states tax base - were given out by Michigan ($7.1 billion) ...

UPDATE, II (Nov. 4, 2013): This review from the Detroit Free Press is an impressive work that helps us understand the managerial incompetence in Detroit that made the impact of American-led globalization and outsourcing worse than they should have been ... http://www.freep.com/interactive/article/20130915/NEWS01/130801004/Detroit-Bankruptcy-history-1950-debt-pension-revenue

Thursday, August 1, 2013

WE'RE #1, WE'RE #1 ... 8 NOT SO GOOD WAYS THE U.S. LEADS THE WORLD

From Alternet.org, the 8 shocking ways the U.S. leads the world ...

1. Most expensive place to have a baby.

2. Obesity.

3. Anxiety disorders.

4. Small arms ownership.

5. Most people behind bars.

6. Energy use per person.

7. Amount of GDP dedicated to health care (17.6).

8. Cocaine use.

To this I would add having the most misinformed news watchers in the free world, courtesy of Fox News. This would change, of course, if we throw in North Korea and other tyrannical states.

- Mark

Subscribe to:

Posts (Atom)