I have written about corporate welfare many times. I like to discuss this topic because almost every day we hear from conservative pundits and politicians that we need to end our culture of entitlements. The Republican Party has become particularly adept at getting America to believe that "dependence on government" is an economic and cultural sin that needs to be eradicated.

But, as I've pointed out in numerous posts (here, here, and here), government assistance comes in many forms, especially for the private sector.

FAVORABLE LEGISLATION: Market subsidies, market protections, market interventions, regulatory favors, favorable legislation, legal protections, ex-post facto reclassification's, government spending (Keynesian), artificially low interest rates (monetary policy), government takeovers of private sector "assets" (not what you think), and government bailouts (all discussed here and here) are only the tip of the ice berg.

SUBSIDIZING MARKET EFFICIENCY VIA SOCIAL POLICY: On a general level the state also has to protect freedom and individual rights, which subsidizes markets by helping markets function more efficiently. More specifically, as I've pointed elsewhere (and in my book), the modern state has to work consistently to remove or soften the impact of market enemies like market conspiracies (monopoly, oligopolies, etc.), societal prejudices (racism, sexism, etc.), government-corporate collusion or capture (favorable legislation, slavery, bailouts, regulatory capture, etc.), hereditary privileges (inheritances, wealth transfers, etc.), and outright corruption and theft.

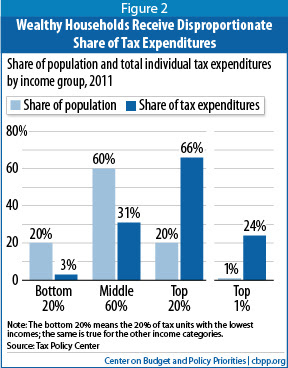

HIDDEN GIFTS: Then we have "hidden" corporate subsidies that come in the form of tariff protections, dirt cheap land leases, royalty gifts to the oil industry, more than a trillion dollars in tax gifts, and increasingly longer copyright protections which are coupled with broader interpretations of what can be patented (especially good for drug and food manufacturers), which the New Yorker's James Surowiecki discusses here.

All of these subsidies, protections, and legislative gifts are backstopped and transferred by the state.

The reason I bring all of this up is because several of my conservative FB friends continue to point to the cost of government spending for housing and other welfare related expenditures. They claim it's busting the national bank. They're wrong.

The problem is that they never provide numbers and, quite frankly, don't know what the hell they're talking about (e.g. they like to conflate social security and Medicare with our budget mess when neither have anything to do with our current budget picture). My concern is that they choose to ignore (or never learn?) what Mike Sinn points out here.

Specifically, the almost $100 billion that we give as direct government subsidies for "corporate welfare" far outpaces the almost $60 billion we spend annually on traditional "social welfare" programs. Specifically, we spend $17.6 billion on Temporary Assistance for Needy Families, (or TANF) and $41.7 billion on housing programs - where 54 percent of HUD-assisted households goes to the elderly or disabled - which adds up to $40 billion less than what we spend on direct corporate subsidies.

This corporate-social welfare gap explodes far beyond $40 billion if we consider the more than $4 trillion (yes, that's a trillion with a "t") that's been turned over to Wall Street and the financial sector since 2008, and the $16 trillion that we're now on the hook for as we continue to guarantee and subsidize our financial sectors economic recovery.

Here's what we should all understand from what's presented here. The GOP and their media noise machine on the right (Fox News is not alone) only want to cut welfare for the poor. They want you and everyone else to ignore corporate welfare for the private sector ($100 billion in subsidies + over a trillion in tax expenditure gifts + the trillions in post-2008 assistance).

The $40 billion gap between what we spend on direct corporate welfare ($100 billion) and traditional social welfare ($59.3 billion) is actually much larger. Much, much larger. The trillion dollars we give away in tax breaks (tax "expenditures") and the multi-trillion bailout program(s) that we crafted for Wall Street after 2008 should be ample evidence of this.

Unfortunately, many Americans simply don't see it. Sigh ...

- Mark

Addendum (11-5-15): Eventually I'm going to update this post. Until then, know that the Federal Reserve of St. Louis has a nice graph that shows the trillions of dollars in post-2008 market subsidies that I reference in this post. If you're not a policy geek here's an an explanation and link I posted, which provides a skyscraper 'visual' of the more than $4 trillion that we've dumped in to Wall Street since the 2008 market collapse.

I have another post here that shows how we've - in the words of one Federal Reserve director - created a "beer goggles economy" for market players with all the cheap money we've (through the Federal Reserve) released. So you know, we're on the hook for trillions more. Be sure to follow the links.

Again, I will revise and update this post at some point.

But, as I've pointed out in numerous posts (here, here, and here), government assistance comes in many forms, especially for the private sector.

FAVORABLE LEGISLATION: Market subsidies, market protections, market interventions, regulatory favors, favorable legislation, legal protections, ex-post facto reclassification's, government spending (Keynesian), artificially low interest rates (monetary policy), government takeovers of private sector "assets" (not what you think), and government bailouts (all discussed here and here) are only the tip of the ice berg.

SUBSIDIZING MARKET EFFICIENCY VIA SOCIAL POLICY: On a general level the state also has to protect freedom and individual rights, which subsidizes markets by helping markets function more efficiently. More specifically, as I've pointed elsewhere (and in my book), the modern state has to work consistently to remove or soften the impact of market enemies like market conspiracies (monopoly, oligopolies, etc.), societal prejudices (racism, sexism, etc.), government-corporate collusion or capture (favorable legislation, slavery, bailouts, regulatory capture, etc.), hereditary privileges (inheritances, wealth transfers, etc.), and outright corruption and theft.

HIDDEN GIFTS: Then we have "hidden" corporate subsidies that come in the form of tariff protections, dirt cheap land leases, royalty gifts to the oil industry, more than a trillion dollars in tax gifts, and increasingly longer copyright protections which are coupled with broader interpretations of what can be patented (especially good for drug and food manufacturers), which the New Yorker's James Surowiecki discusses here.

All of these subsidies, protections, and legislative gifts are backstopped and transferred by the state.

The reason I bring all of this up is because several of my conservative FB friends continue to point to the cost of government spending for housing and other welfare related expenditures. They claim it's busting the national bank. They're wrong.

The problem is that they never provide numbers and, quite frankly, don't know what the hell they're talking about (e.g. they like to conflate social security and Medicare with our budget mess when neither have anything to do with our current budget picture). My concern is that they choose to ignore (or never learn?) what Mike Sinn points out here.

Specifically, the almost $100 billion that we give as direct government subsidies for "corporate welfare" far outpaces the almost $60 billion we spend annually on traditional "social welfare" programs. Specifically, we spend $17.6 billion on Temporary Assistance for Needy Families, (or TANF) and $41.7 billion on housing programs - where 54 percent of HUD-assisted households goes to the elderly or disabled - which adds up to $40 billion less than what we spend on direct corporate subsidies.

This corporate-social welfare gap explodes far beyond $40 billion if we consider the more than $4 trillion (yes, that's a trillion with a "t") that's been turned over to Wall Street and the financial sector since 2008, and the $16 trillion that we're now on the hook for as we continue to guarantee and subsidize our financial sectors economic recovery.

Here's what we should all understand from what's presented here. The GOP and their media noise machine on the right (Fox News is not alone) only want to cut welfare for the poor. They want you and everyone else to ignore corporate welfare for the private sector ($100 billion in subsidies + over a trillion in tax expenditure gifts + the trillions in post-2008 assistance).

The $40 billion gap between what we spend on direct corporate welfare ($100 billion) and traditional social welfare ($59.3 billion) is actually much larger. Much, much larger. The trillion dollars we give away in tax breaks (tax "expenditures") and the multi-trillion bailout program(s) that we crafted for Wall Street after 2008 should be ample evidence of this.

Unfortunately, many Americans simply don't see it. Sigh ...

- Mark

Addendum (11-5-15): Eventually I'm going to update this post. Until then, know that the Federal Reserve of St. Louis has a nice graph that shows the trillions of dollars in post-2008 market subsidies that I reference in this post. If you're not a policy geek here's an an explanation and link I posted, which provides a skyscraper 'visual' of the more than $4 trillion that we've dumped in to Wall Street since the 2008 market collapse.

I have another post here that shows how we've - in the words of one Federal Reserve director - created a "beer goggles economy" for market players with all the cheap money we've (through the Federal Reserve) released. So you know, we're on the hook for trillions more. Be sure to follow the links.

Again, I will revise and update this post at some point.

2 comments:

Excellent post!!!! I argue this point all the time. Let's pick on the little guy who needs welfare (you know it is easier to pick on the defenseless) while turning a blind eye to corporate welfare which is sucking us dry. I know an International company with a division in the United States that virtually pays zero taxes and they made 20 billion last year! No one one wants to talk about this. Let's just pick on the person that needs food stamps. It enrages me.

I agree on stopping the corporation welfare, such as the banks, and the auto industry. Stop that, but allow the corporation to pay a little less in taxes, say from 35% to 25%. then work from there for other option. Get jobs back in the states, get the welfare crowd situation such as training,in marketable skills, not the media as an actor, writer, producer, anchor person etc. And if companies are in the states to help them be matched up with the skills they have for the job that is open. Also tax cuts for the working class.

Post a Comment